(Finance) – The main European stock exchanges closed with contrasting signs, where the square in Paris was highlighted in the aftermath of the televised confrontation between the candidates for the Elysée, Emmanuel Macron and Marine Le Pen, with the incumbent president given the lead. Investors’ attention remains focused on the corporate quarterly reports and on the issue of‘inflation and moves ECB. The vice president de Guindos expects the end of market purchases in July and subsequently the start of the rate squeeze.

On the currency market, theEuro / US dollar, which trades on the eve of 1.085. Loses groundgold, which trades at $ 1,939.2 an ounce, retracing 0.93%. Oil (Light Sweet Crude Oil), on the rise (+ 1.46%), reaches 103.7 dollars per barrel.

On parity it spreadwhich remains at +165 basis points, with the yield on the ten-year BTP standing at 2.57%.

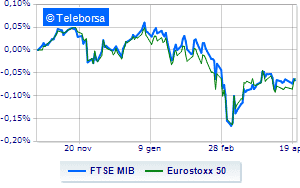

In the European stock market scenario well set up Frankfurtwhich shows an increase of 0.98%, without cues London, which does not show significant changes in prices; toned Paris which shows a nice advantage of 1.36%. Weak session for the Milanese list, which ends with a drop of 0.29% on FTSE MIBwhile, on the contrary, the FTSE Italia All-Sharewhich increases compared to the day before reaching 27,163 points.

On the Milan Stock Exchange it appears that the exchange value in today’s session it amounted to € 2.22 billion, from € 2.27 billion in the previous session; while the volumes traded today went from 0.55 billion shares of the previous session to today’s 0.49 billion.

Between best Italian stocks large-cap, buy hands-on Saipemwhich boasts an increase of 11.80%.

Effervescent Pirelliwith an increase of 2.63%.

In light Interpumpwith a large increase of 1.52%.

Positive trend for Mediobancawhich is up by a decent + 1.01%.

The strongest declines, on the other hand, occurred on Snamwhich closed the session at -3.25%.

Letter on Ternawhich records a significant decrease of 2.31%.

Prey of the sellers Herawith a decrease of 1.86%.

Sales focus on A2Awhich suffers a decline of 1.85%.

Among the protagonists of the FTSE MidCap, Brembo (+ 5.01%), Carel Industries (+ 4.98%), Datalogic (+ 4.72%) e Zignago Glass (+ 4.58%).

The strongest declines, on the other hand, occurred on ENAVwhich closed the session at -4.09%.

Goes down IRENwith a fall of 3.02%.

Collapses Alerion Clean Powerwith a decrease of 2.78%.

Sales hands on Mutuionlinewhich suffers a decrease of 2.04%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Thursday 21/04/2022

11:00 am European Union: Consumption prices, annual (expected 7.5%; previous 5.9%)

11:00 am European Union: Consumption prices, monthly (expected 2.5%; previous 0.9%)

14:30 USA: PhillyFed (expected 21 points; preceding 27.4 points)

14:30 USA: Unemployment Claims, Weekly (Expected 180K Units; Previously 186K Units)

4:00 pm European Union: Consumer confidence (expected -20 points; prev. -18.7 points).