(Finance) – The main European stock exchanges extend the rise of the first part of the session, while there are mixed signals from US derivatives that suggest a two-speed departure for the Wall Street stock exchange later. Investors’ attention always remains high on war in Ukrainewhile continuing the quarterly season corporate.

On the currency market, slight growth ofEuro / US dollar, which rises to an altitude of 1.084. L’Gold the session continued at the levels of the day before, reporting a variation of + 0.19%. Oil (Light Sweet Crude Oil), on the rise (+ 0.94%), reaches 103.5 dollars per barrel.

Consolidate the levels of the eve it spreadsettling at +163 basis points, with the yield of the ten-year BTP standing at 2.48%.

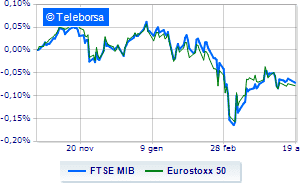

Among the Euroland indices sustained Frankfurtwith a decent gain of 1.01%, colorless London, which does not register significant changes compared to the previous session; good ideas on Paris, which shows a large lead of 1.14%. Plus sign for the Italian price list, with the FTSE MIB up by 0.81%; on the same line, earnings day for the FTSE Italia All-Sharewhich continues the day at 27,106 points.

Among the best Blue Chips di Piazza Affari, the banking sector, which does not seem to be affected by the alarm raised by Credit Suisse, which said it expected a loss in the first quarter due to greater reserves for legal disputes, was revived. Tonic the Banco BPM (+ 4.84%). Effervescent Mediobanca, with an increase of 2.90%. Glowing BPERwhich boasts an incisive increase of 2.86%.

Shopping hands-on STMicroelectronicswhich boasts a 3.45% increase in the wake of the run of Asml on the Amsterdam Stock Exchange, thanks to quarterly accounts.

The strongest sales, on the other hand, show up on Amplifonwhich continues trading at -1.42%.

The negative performance of Telecom Italiawhich falls by 1.14%.

Basically weak Generali Insurancewhich recorded a decrease of 0.64%.

It moves below par Ternashowing a decrease of 0.59%.

Between best stocks in the FTSE MidCapfly Intercos (+ 7.72%) thanks to an upgrade. Well besides, Credem (+ 4.99%), Maire Tecnimont (+ 3.32%) e Danieli (+ 2.78%).

The strongest falls, on the other hand, occur on Autogrillwhich continues the session with -5.46%.

MARR drops by 1.64%.

Decline for OVSwhich marks a -1.61%.

Moderate contraction for Wiitwhich suffers a decline of 0.87%.

Between the data relevant macroeconomics:

Wednesday 20/04/2022

01:50 Japan: Balance of trade (expected ¥ 100.8bn; previous ¥ -668.3bn)

06:30 Japan: Services index, monthly (previous -0.2%)

08:00 Germany: Production prices, annual (expected 28.2%; previous 25.9%)

08:00 Germany: Production prices, monthly (expected 2.6%; previous 1.4%)

11:00 am European Union: Industrial production, annual (expected 1.5%; previous -1.5%).