(Finance) – Bad day for Piazza Affari and the other main European stock exchangesafter yesterday’s US inflation data fueled speculation about higher interest rates for longer, while weak Chinese inflation data this morning raised concerns about the global economy.

On the macroeconomic frontin France the final inflation reading for September confirmed a change of +4.9% on an annual basis, while in Spain was confirmed at +3.5%. Previously, it emerged that in China in September inflation surprised on the downside, settling at 0% y/y from +0.1% in August, conditioned by the decline in consumer goods (-0.9% y/y) against stable growth in service prices (+1.3% y/y).

Regarding the monetary policyyesterday i ECB minutes they confirmed that the decision on rates was considered “difficult”, but that in the end a “solid majority” was formed in favor of the increase because many believed that stopping at the first moment of uncertainty would give a signal of lack of determination. Across the ocean, Susan Collins (Boston Fed) said it will take time to get inflation back to the 2% target but, in the short term, high rates on long-term Treasuries could reduce the need for further tightening of monetary policy.

No significant changes forEuro / US Dollar, which trades on the day before at 1.052. L’Gold the session continues on the rise and advances to 1,892.9 dollars an ounce. Strong earnings day for the petrolium (Light Sweet Crude Oil), up 3.97%, after the United States tightened sanctions on Russian crude exports, exacerbating supply concerns in an already balanced energy market.

The Spreads worsens, reaching +201 basis points, with an increase of 5 basis points compared to the previous value, with the yield of the ten-year BTP equal to 4.72%.

In the European stock market scenario substantially weak Frankfurtwhich recorded a decline of 0.68%, moved below parity Londonhighlighting a decrease of 0.31%, and moderate contraction for Pariswhich suffers a drop of 0.65%.

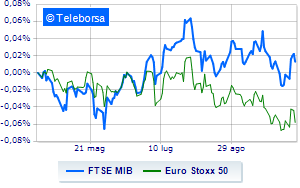

It moves fractionally lower Business Squarewith the FTSE MIB which is leaving 0.41% on the floor, breaking the positive chain of three consecutive increases, which began last Tuesday; on the same line, the FTSE Italia All-Share, which relegates to 30,194 points. Negative the FTSE Italia Mid Cap (-0.99%); as well as, negative variations for the FTSE Italia Star (-1.34%).

Among the best Blue Chips of Piazza Affari, effervescent Telecom Italia, with an increase of 4.07%. Good performance for BPER, which grows by 2.35%. Supported Tenaris, with a decent gain of 1.85%. Resistant Saipemwhich marks a small increase of 1.46%.

The worst performances, however, are recorded on Generali Bank, which gets -3.79%. It slides DiaSorin, with a clear disadvantage of 3.78%. In red Fineco, which highlights a sharp decline of 3.27%. The negative performance of Campariwhich fell by 3.16%.

At the top of the mid-cap stocks ranking from Milan, Maire Tecnimont (+1.47%), Intercos (+1.14%), Cementir (+1.05%) e Ascopiave (+1.00%).

The strongest sales, however, occur at Seco, which continues trading at -13.77%. Significant losses for GVSdown 4.66%. Ariston Holding drops by 3.75%. Decline decided for Replywhich marks -3.42%.