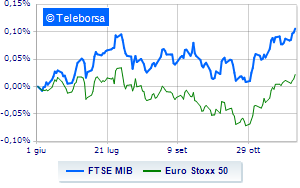

(Finance) – After the powerful rally in November, the European stock markets start the month of December with a rising sessionwith the FTSE MIB hovering just below the threshold of 30 thousand points, i.e. at the highest levels since 2008.

On the macroeconomic front, in Italy the definitive reading of 3rd quarter GDP was improved, showing variations of +0.1% q/y and +0.1% y/y (compared to 0% preliminary), while in theeurozone the final reading of November Manufacturing PMI led to an upward revision to 44.2 from 43.8: confidence, however, remained consistent with a contraction in activity, which is however easing thanks to production and orders.

European markets have not been affected since speech by Jerome Powell, chairman of the Federal Reserve, who arrived in the last part of the session. The number one US central bank said it was “premature to conclude with confidence that we have reached a sufficiently restrictive stance, or to speculate on when policy might ease” that “we are ready to tighten policy further if this proves appropriate”.

No significant changes forEuro / US Dollar, which trades on the day before at 1.088. Positive session forgold, which is bringing home a gain of 1.07%. Slight increase for petrolium (Light Sweet Crude Oil), which shows an increase of 0.17%.

It retreats slightly spreadwhich reaches +174 basis points, showing a small decrease of 3 basis points, while the yield of the 10-year BTP stands at 4.10%.

Among the Euroland indices money up Frankfurtwhich recorded an increase of 1.12%, a decidedly positive balance for Londonwhich boasts an increase of 1.01%, and session without momentum for Parisreflecting a moderate increase of 0.48%.

Increase for the Milan Stock Exchangewith the FTSE MIB which rises by 0.64% to 29,928 points, continuing the bullish trail highlighted by four consecutive gains, triggered last Tuesday; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 31,894 points. In fractional progress the FTSE Italia Mid Cap (+0.5%); with a similar direction, just above parity FTSE Italia Star (+0.37%).

At the close of the Milan Stock Exchange, the exchange value in the session of 12/1/2023 it was equal to 1.98 billion euros, a marked decrease (-66.65%) compared to the previous session which had seen the trading of 5.94 billion euros; while the volumes traded went from 1.43 billion shares in the previous session to 0.69 billion.

Among the best Blue Chips of Piazza Affari, incandescent CNH Industrial, which boasts a significant increase of 4.93%. Good performance for Prysmian, which grows by 3.31%. Supported Saipem, with a decent gain of 2.45%. Good insights on Tenariswhich shows a large lead of 2.13%.

The steepest declines, however, occurred on Amplifon, which ended the session at -1.33%. Thoughtful Ferrariwith a fractional decline of 0.54%.

At the top among Italian shares a mid-cap, Antares Vision (+7.90%), Technogym (+6.88%), OVS (+3.02%) e Salcef Group (+2.98%).

The strongest sales, however, hit GVS, which ended trading at -4.72%. It slides MFE A, with a clear disadvantage of 1.86%. He hesitates Digital Value, with a modest decline of 1.43%. Slow day for MFE Bwhich marks a decline of 1.31%.