(Finance) – The European markets are not very movedwaiting for FED President’s speech at the Jackson Hole Annual Symposium, although the world’s leading central banker may well choose not to provide further clues as to the direction of US monetary policy. “President Powell is unlikely to answer the many questions hanging around the market, and he may not even address them, as Jackson Hole has often been the forum for more theoretical or long-term discussions rather than short-term prospects.” , notes Eric Winograd, Senior VP and US Economist of AllianceBernstein.

Meanwhile, investors find themselves assessing the trend in consumer confidence in the main European economies. According to Istat, the confidence of Italian companies it was down for the second consecutive month in August, while the consumer sentiment it returned to June levels, which were still low.

The trust of the German consumers, according to data from the GfK institute, it fell to a new all-time low for the third consecutive month, with the propensity to save rising to its highest value in more than eleven years. In France consumer confidence improved slightly in August.

Liquidity continues to represent the preferred form of savings allocation by Italians, even if the need for greater diversification towards mutual funds and insurance policies is growing, according to what emerges from an analysis by the FABI banking syndicate on savings of Italians over the last ten years.

L’Euro / US dollar maintains its position substantially stable at 0.9985. Weak session forgold, which trades with a drop of 0.35%. Slight increase for the Petroleum (Light Sweet Crude Oil), which shows a rise of 0.42%.

Jump up it spreadpositioning itself at +230 basis points, with an increase of 6 basis points, with the yield of Ten-year BTP equal to 3.63%.

In the European stock market scenario flat Frankfurtwhich holds equality, without cues Londonwhich does not show significant changes in prices, and stops Pariswhich marks almost nothing.

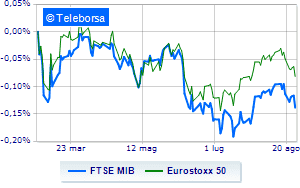

Caution prevails a Business Squarewith the FTSE MIB which continues the session with a slight decrease of 0.24%; on the same line, depressed the FTSE Italia All-Share, which trades below the levels of the eve of 24.479 points. Consolidate eve levels on FTSE Italia Mid Cap (0%); slightly down on FTSE Italia Star (-0.29%).

Between best performers of Milan, in evidence Telecom Italia (+ 1.79%), Prysmian (+ 1.03%), Unipol (+ 0.77%) e Stellantis (+ 0.54%).

The worst performances, on the other hand, are recorded on Recordatiwhich gets -1.77%.

The negative performance of Amplifonwhich falls by 1.51%.

Campari drops by 1.29%.

Decline for Ivecowhich marks a -1.16%.

At the top among Italian stocks a mid cap, Alerion Clean Power (+ 4.59%), Saras (+ 2.87%), El.En (+ 1.95%) e Webuild (+ 1.40%).

The worst performances, on the other hand, are recorded on GVSwhich gets -2.69%.

Under pressure SOLwith a sharp decline of 1.92%.

Suffers Intercoswhich shows a loss of 1.30%.

Prey of the sellers Mondadoriwith a decrease of 1.07%.