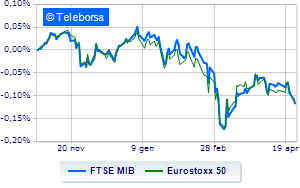

(Finance) – European stock exchanges lose momentum and close in red following the negative performance of Wall Street in the wake of persistent tensions on the war in Ukrainewhile the continuation of the new lockdown in Shanghai raises fears of slowdowns in China and new problems on supply chains worldwide.

On the currency market, theEuro / US dollar the session continues just below par, with a drop of 0.50%. The dollar, on the other hand, continues to strengthen on the prospects of rate hikes by the Federal Reserve. L’Gold shows a shy gain, with a progress of 0.32%. Euphoric session for crude oil, with oil (Light Sweet Crude Oil) showing a jump of 2.75%.

On the levels of the eve it spreadwhich remained at +173 basis points, with the yield on the ten-year BTP standing at 2.53%.

Among the Euroland indices slips Frankfurtwith a clear disadvantage of 1.20%, it remains close to par London (+ 0.08%); slow day for Paris, which marks a decrease of 0.54%. Minus sign in closing for the Milanese list, in a session characterized by large sales, with the FTSE MIB which accuses a drop of 0.95%: the main index of the Milan Stock Exchange thus continues a negative series, which began last Thursday, of four consecutive declines; on the same line, it closes in reverse the FTSE Italia All-Sharewhich slips to 26,172 points.

On the Milan Stock Exchange, the exchange value in today’s session it amounted to € 2.07 billion, down by € 399.8 million, compared to € 2.47 billion the previous day; volumes stood at 0.6 billion shares, compared with the previous 0.62 billion.

Among the best Blue Chips of Piazza Affari, purchases with full hands on Tenariswhich boasts an increase of 3.53%.

Sustained Prysmianwith a decent gain of 1.19%.

Small step forward for Iveco Groupwhich shows a progress of 0.82%.

Composed A2Awhich grew by a modest + 0.74%.

The worst performances, however, were recorded on Unicreditwhich closed at -3.22%.

Heavy Stellantiswhich marks a drop of -3.19 percentage points.

Negative sitting for DiaSorinwhich falls by 2.62%.

Sensitive losses for Pirellidown 2.53%.

Top of the ranking of mid-cap stocks from Milan, MPS Bank (+ 4.13%), IREN (+ 2.64%), Anima Holding (+ 1.98%) e Danieli (+ 0.92%).

Stronger sales, on the other hand, fell on Saint Lawrencewhich ended trading at -7.56%.

Breathless Mutuionlinewhich falls by 5.28%.

Thud of Sesawhich shows a fall of 4.42%.

Letter on Tod’swhich records a significant drop of 3.77%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Tuesday 26/04/2022

half past one Japan: Unemployment rate (expected 2.7%; previous 2.7%)

14:30 USA: Durable goods orders, monthly (1% expected; previous -1.7%)

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (expected 19%; previous 19.1%)

4:00 pm USA: New house sales, monthly (formerly -1.2%).