(Tiper Stock Exchange) – European stock markets ended the week with a weak sessionas investors are concerned about future moves by central banks and especially by the ECBas producer prices in Germany rose more than expected in January and Eurozone inflation is likely to remain high for longer.

Francois Villeroy de Galhaugovernor of the French central bank, said ECB interest rates will likely peak over the summer and a rate cut this year is out of the question. Isabel Schnabela member of the ECB’s executive board, said investors may be underestimating the persistence of inflation in the Eurozone.

Basically stable theEuro / US Dollar, which continues the session on the previous day’s levels and stops at 1.067. No significant change for thegold, which trades on the previous day’s values at 1,838.4 dollars an ounce. The Petrolium (Light Sweet Crude Oil) slumped 3.35%, dropping to $75.86 per barrel.

Advance a little spreadswhich rises to +178 basis points, showing an increase of 3 basis points, with the yield of the 10-year BTP equal to 4.19%.

Among the indices of Euroland moderate contraction for Frankfurtwhich suffers a drop of 0.33%, subdued London showing a filing of 0.21%, and disappointing Pariswhich lies just below the levels of the eve.

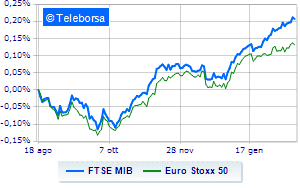

Caution prevails in closing a Business Squarewith the FTSEMIB which closes the session with a slight drop of 0.37%, breaking the positive chain of four consecutive rises, which began last Monday, while, on the contrary, the FTSE Italia All-Sharewhich increases compared to the day before, reaching 30,099 points.

Below parity the FTSE Italia Mid Cap, which shows a decline of 0.36%; along the same lines, slightly negative the FTSE Italy Star (-0.45%).

The exchange value in today’s session in Piazza Affari it was equal to 2.77 billion euros, with an increase of no less than 354.8 million euros, equal to 14.72%, compared to the previous 2.41 billion; while the volumes traded went from 0.75 billion shares in the previous session to today’s 0.8 billion.

At the top of the ranking of the most important titles of Milan, we find BPER (+4.41%), Telecom Italy (+2.52%), CNH Industrial (+1.37%) and Inwit (+0.96%).

The strongest declines, however, occurred on Tenaris, which closed the session at -4.79%. Bad sitting for ENI, which shows a loss of 2.81%. Under pressure amplifier, which shows a drop of 2.70%. Slide Pirelliwith a clear disadvantage of 1.94%.

Among the protagonists of the FTSE MidCap, MPS Bank (+6.82%), Banca Ifis (+4.19%), believe (+2.36%) and doValue (+1.56%).

The strongest sales, however, fell on Dry, which finished trading at -3.61%. In red MARR, which shows a marked decrease of 2.91%. The negative performance of Intercoswhich drops by 2.48%. Sesa drops by 2.21%.