(Tiper Stock Exchange) – European stock exchanges move slightly higher after industrial orders in Germany grew more than expected in June (+7% m/m after +6.4% the previous month), but the climate is still wait-and-see. Today’s focus will be on theUnited States July Employment Reportexpected to record an increase in non-agricultural employees of 200 thousand units, after 209 thousand in June (a minimum since December 2021).

On the front ECBYesterday Fabio Panetta (member of the executive committee and forthcoming governor of the Bank of Italy) argued in a speech the superiority of an approach based on persistence rather than on the level of the restriction.

Meanwhile, in Milan turns positive mps extension, although it has slowed since the initial flare-up, after it closed the second quarter with a profit of 383.3 million euros, up 62.6% on the previous quarter and well above the consensus of 217 million provided by the bank . The CEO Lovaglio spoke of a bank “on track to exceed the €1 billion net profit target for the full year, ahead of business plan targets“.

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of -0.05%. L’Gold the session continued at the previous levels, reporting a variation of -0.06%. No significant changes for the oil market, with the petrolium (Light Sweet Crude Oil) which stands at the values of the previous day at 81.69 dollars per barrel.

It retreats a little spreadswhich reaches +166 basis points, showing a small decline of 2 basis points, while the yield of the 10-year BTP it stands at 4.25%.

Among the main European Stock Exchanges little moved Frankfurtwhich shows +0.15%, substantially unchanged Londonwhich reports a moderate +0.04%, and sitting without momentum for Parisreflecting a moderate increase of 0.39%.

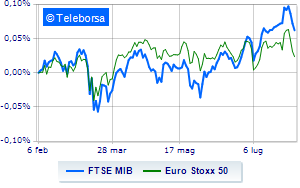

TO MilanThe FTSEMIB it is substantially stable and stands at 28,748 points; along the same lines, stay flat the FTSE Italia All-Share, with the quotations standing at 30,774 points. Just above parity the FTSE Italia Mid Cap (+0.22%); as well as, fractional earnings for the FTSE Italy Star (+0.38%).

Among the best Blue Chips of Piazza Affari, a decidedly positive balance for Leonardo, which boasts an increase of 2.27%. Good performance for MPS Bank, which grows by 2.19%. sustained Tenaris, with a decent gain of 1.98%. Good insights on Ivecoshowing a large lead of 1.87%.

The worst performances, however, are recorded on DiaSorin, which gets -1.25%. Moderate contraction for STMicroelectronics, which suffers a drop of 1.03%. Undertone Register showing a filing of 0.74%. Disappointing Triadwhich lies just below the levels of the eve.

Among the protagonists of the FTSE MidCap, Saint Lawrence (+4.26%), Datalogic (+3.93%), Illimity Bank (+3.72%) and Ferragamo (+2.91%).

The strongest sales, on the other hand, show up Intercos, which continues trading at -4.76%. Letter about WIIT, which records a significant drop of 4.01%. In red Ariston Holding, which shows a marked decrease of 2.08%. Slack Eurogroup Laminationswhich shows a small decrease of 1.37%.