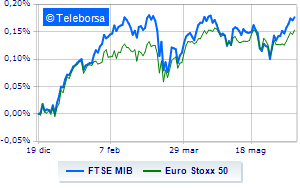

(Tiper Stock Exchange) – The main Euroland markets are moving in positive territory. On the same bullish trail the FTSEMIB. On the New York Stock Exchange, theS&P-500.

The volatility caused by the so-called “four witches”, the maturities of futures and options on stocks and indices for 4,200 billion dollars globally, also affected the performance of the session

On the currency market, no significant changes for theEuro / US Dollar, which trades on the previous day’s values of 1.093. Basically stable thegold, which continues the session on the previous day’s levels at 1,958.6 dollars an ounce. Slight increase in oil (Light Sweet Crude Oil) which rises to 70.97 dollars per barrel.

It goes down a lot spreadsreaching +148 basis points, with a sharp drop of 8 basis points, with the yield on the 10-year BTP standing at 3.95%.

Among the main European Stock Exchanges moderate gain for Frankfurtwhich advanced 0.41%, lacking momentum London, trading with +0.19%; toned Paris which highlights a nice advantage of 1.34%. Slight increase for the Milan Stock Exchange, which shows on FTSEMIB an increase of 0.47%; along the same lines, the FTSE Italia All-Share it advances fractionally, reaching 30,012 points.

Between best performers of Milan, in evidence DiaSorin (+3.06%), BPM desk (+2.64%), Moncler (+2.56%) and Unicredit (+2.19%).

The strongest declines, however, occur on Tenariswhich continues the session with -1.15%.

Slack General Insurancewhich shows a small decrease of 1.14%.

Modest descent for Pirelliwhich drops a small -0.6%.

Thoughtful ENIwith a fractional decline of 0.55%.

Between best stocks in the FTSE MidCap, doValue (+2.87%), Reply (+2.82%), De’Longhi (+2.51%) and Brunello Cucinelli (+2.21%).

The strongest sales, on the other hand, show up OVS extensionwhich continues trading at -2.45%.

Under pressure MFE Bwith a sharp drop of 1.81%.

He suffers MARRwhich shows a loss of 1.63%.

Prey of sellers CIRwith a decrease of 1.57%.