(Finance) – Milan is weak, in the wake of the other Eurozone stock exchanges, albeit with limited drops supported by the push of energy stocks which benefit from the rush of oil towards 100 dollars. At the same time, this race worries investors about inflationary pressures and doubts about the next moves of central banks.

On the currency market, theEuro / US Dollar the session continues at the levels of the day before, reporting a change of +0.12%. L’Gold it is essentially stable at $1,875 an ounce. Session in fractional decline for oil (Light Sweet Crude Oil), which leaves, for now, 0.40% on the floor.

It advances a little spreadwhich reaches +195 basis points, highlighting an increase of 2 basis points, with the yield on the 10-year BTP equal to 4.83%.

Among the markets of the Old Continent subdued Frankfurt which shows a filing of 0.25%, suffers Londonwhich shows a loss of 0.73%, and nothing has been done for Pariswhich changes hands on parity.

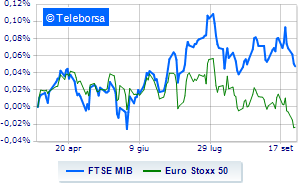

In Milan, it moves below parity FTSE MIB, which drops to 27,896 points, with a percentage difference of 0.41%, continuing on the bearish trail represented by six consecutive drops, existing since last Thursday; on the same line, depressed the FTSE Italia All-Sharewhich trades below the levels of the day before at 29,729 points.

On equality the FTSE Italia Mid Cap (+0.08%); slightly down FTSE Italia Star (-0.36%).

Campariwhich achieved +0.51%, is theunique among the Blue Chips of Piazza Affari to report an appreciable performance.

The worst performances, however, are recorded on Telecom Italiawhich gets -2.88% the day after the Board conceded to KKR

the extension to 15 October for the offer on Netco.

Prey for sellers Ivecowith a decrease of 2.59%.

They focus on sales Pirelliwhich suffers a decline of 2.37%.

Sales up Unicreditwhich recorded a decline of 1.75%.

Between best stocks in the FTSE MidCap, Eurogroup Laminations (+3.74%), Danieli (+3.21%), Zignago Glass (+1.74%) e Buzzi Unicem (+1.41%).

The strongest sales, however, occur at Antares Visionwhich continues trading at -2.53%.

Negative session for Intercoswhich shows a loss of 1.74%.

Under pressure Saraswhich suffered a decline of 1.51%.