(Finance) – It moves in the name of caution the session of the main European stock exchanges. The Milan stock exchange also aligns itself with the caution that reigns in Europe, and trades on the parity line. The day is poor in ideas on the macro front and investors are waiting for a series of relevant data – starting from the preliminary data on European inflation – which will characterize the next sessions. The readings expected in the next few days should provide an indication of both the price dynamics and the health of the European economies, and will serve to understand what the ECB’s attitudes could be at the December meeting. Today the focus is on the words of Christine Lagardewhich appears at the Committee on Economic and Monetary Affairs (ECON) of the European Parliament.

No significant changes forEuro / US Dollar, which trades on the day before at 1.095. Slight increase ingold, which rises to 2,012.7 dollars an ounce. Slight decline in petrolium (Light Sweet Crude Oil), which drops to 74.65 dollars per barrel.

Slight improvement of spreadwhich drops to +172 basis points, a decrease of 2 basis points, while the yield of the 10-year BTP stands at 4.31%.

Among the main European stock exchanges colorless Frankfurtwhich does not record significant changes compared to the previous session, moves below parity Londonshowing a decrease of 0.29%, and without momentum Pariswhich trades with -0.08%.

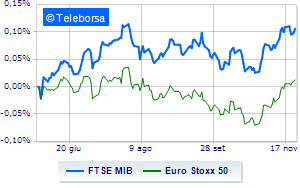

In Milan, the FTSE MIB it is substantially stable and stands at 29,397 points; along the same lines, a day without infamy and without praise for the FTSE Italia All-Sharewhich remains at 31,348 points.

On equality the FTSE Italia Mid Cap (-0.16%); as well, without direction the FTSE Italia Star (+0.02%).

Between best performers of Milan, highlighted Amplifon (+2.36%), Telecom Italia (+1.96%), A2A (+1.71%) e ERG (+1.65%).

The worst performances, however, are recorded on Leonardo, which gets -2.89%. Moderate contraction for Stellantis, which suffers a drop of 0.86%. Undertone Unicredit which shows a reduction of 0.78%. Disappointing Saipemwhich lies just below the levels of the day before.

Between best stocks in the FTSE MidCap, Acea (+2.50%), Ascopiave (+2.04%), Caltagirone SpA (+2.03%) e Zignago Glass (+1.90%).

The strongest sales, however, occur at Antares Vision, which continues trading at -2.95%. Negative session for De Nora Industries, which shows a loss of 2.82%. Under pressure Seco, which suffered a decline of 2.68%. It slides Banca Popolare di Sondriowith a clear disadvantage of 2.05%.