(Finance) – Positive closing for the European markets, which however lost ground in the final part of the session. The macro data have been driving the purchases since the morning: euro area inflation fell more than expected in September, at 4.3% (+0.3% m/m) from 5.2% in August, achieving the minimum since October 2021. In Italy, in contrast with the main economies of the euro area, the Inflation fell less than expected, falling to 5.3% from 5.4% in August on the national index. “Italian inflation will decline in the final months of the year due to favorable base effects on the energy component but probably less than expected”, commented Intesa Sanpaolo analysts.

THE Eurozone government bond yields have been declining in today’s session, even if today’s purchasing flows, supported by better than forecast price data, do not allow us to recover the increases accumulated in recent sessions. In this context, the Treasury announced the minimum coupons of the BTP value being placed from Monday: 4.1% for the first three years and 4.5% for the last two, implying an extra return compared to the reference 5-year BTP .

L’Euro / US Dollar maintains the position essentially stable at 1.058. Caution prevails overgold, which continues the session with a slight decline of 0.63%. The Petrolium (Light Sweet Crude Oil) falling (-0.93%) to 90.85 dollars per barrel.

The Spreads improves, reaching +190 basis points, with a decrease of 5 basis points compared to the previous value, with the yield of the ten-year BTP equal to 4.73%.

Among the main European stock exchanges positive balance for Frankfurtwhich boasts an increase of 0.41%, remains close to parity London (+0.08%), and substantially toned Pariswhich recorded a capital gain of 0.26%.

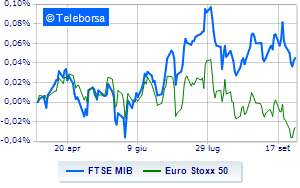

Slight increase for Milan Stock Exchangewith the FTSE MIB which rises by 0.29% to 28,244 points; along the same lines, little leap forward for the FTSE Italia All-Share, which reaches 30,107 points. Good performance FTSE Italia Mid Cap (+1.28%); with a similar direction, rising FTSE Italia Star (+1.46%).

Between best Italian shares large cap, good performance for DiaSorin, which grows by 2.25%. Supported Prysmian, with a decent gain of 1.81%. Good insights on Campari, which shows a large lead of 1.78%. Well set up Inwitwhich shows an increase of 1.72%.

The steepest declines, however, occur at BPM desk, which ends the session with -1.80%. Under pressure Tenaris, which suffered a decline of 1.77%. It slides Iveco, with a clear disadvantage of 1.53%. Undertone Saipem which shows a filing of 1.50%.

At the top of the mid-cap stocks ranking from Milan, Ariston Holding (+4.94%), Danieli (+4.26%), Reply (+4.15%) e Brunello Cucinelli (+3.97%).

The steepest declines, however, occur at Banca Popolare di Sondrio, which continues the session with -2.01%. Disappointing Juventus, which lies just below the levels of the day before. Lame Pharmanutra, which shows a small decrease of 1.01%. Modest descent for Antares Visionwhich drops a small -1.01%.