(Finance) – Negative day for Piazza Affari, which trades heavily, together with the other Eurolistini, after archiving a week of heavy sales. Investor sentiment is weighed down by i fears of a rate hike by the ECB, after the one decided by the Fed the last eighth, to try to give inflation a push. But in a macroeconomic context of slowdown, interest rates are high they could be reflected in the next quarterly reports.

On the central bank front, pay attention to the data arriving on Wednesday 12: it will be published on CPI data on American inflation that it will be important to understand which path the Fed will decide to take with a part of the market that does not trust what the president said Powell and is serving a 75 basis point squeeze that risks slowing economic growth.

On the currency market, slight decline inEuro / US dollar, which drops to 1.051. Loses groundgold, which trades at $ 1,865.1 an ounce, retracing 0.03%. Oil (Light Sweet Crude Oil) loses 1.34% and continues to trade at $ 108.3 per barrel.

Increase it a little spread, which reaches +202 basis points, with a slight increase of 3 basis points, with the yield of the 10-year BTP equal to 3.17%. The differential is returned last week above 200 points, as had not happened since May 2020, also due to the worsening of tension surrounding the Draghi government and the coverage of the DL Aid.

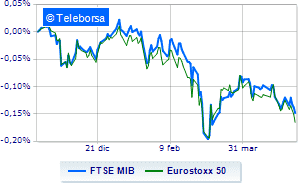

Among the markets of the Old Continent prey of the sellers Frankfurtwith a decrease of 1.16%, sales focus on London, which suffers a decline of 1.17%; letter up Paris, which records a significant decrease of 1.54%. In Piazza Affari, the FTSE MIB it is down (-1.36%) and stands at 23,156 points, continuing the series of four consecutive declines, which began last Wednesday; on the same line, a bad day for the FTSE Italia All-Sharewhich continues the session at 25,268 points, down 1.44%.

Between best performers of Milan, in evidence Leonardo (+ 3.05%) e Tenaris (+ 1.48%).

The worst performances, on the other hand, are recorded on DiaSorinwhich gets -3.61%.

Goes down Iveco Groupwith a decline of 3.22%.

Sales on Nexiwhich recorded a decline of 2.91%.

Collapses Interpumpwith a decrease of 2.90%.

Sole performer among the shares of the FTSE MidCap is Pharmanutrawhich achieves an increase of 0.73%.

The strongest falls, on the other hand, occur on Ferragamowhich continues the session with -4.84%.

Sales hands on Tod’swhich suffers a decrease of 4.01%.

Bad performance for Sesawhich recorded a decline of 3.65%.

Black session for Wiitwhich leaves a loss of 3.64% on the table.

Between macroeconomic variables heavier:

Monday 09/05/2022

08:45 France: Current items (formerly – € 1.1 billion)

4:00 pm USA: Wholesale stocks, monthly (previous 2.5%)

Tuesday 10/05/2022

00:30 Japan: Real household expenses, monthly (expected 2.6%; previous -2.8%)

10:00 Italy: Industrial production, monthly (expected -2%; previous 4%)

10:00 Italy: Industrial production, annual (previous 3.3%).