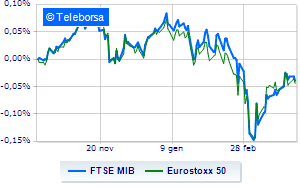

(Finance) – The main European stock exchanges continue in red, at the halfway point, after worsening their performance during the morning. Investor sentiment weighs heavily prospect of new European sanctions on Russia which could affect coal, Russian banks and transport operators, and which could further fuel inflation.

In this regard, various exponents of the Federal Reserve they projected faster and more aggressive hikes in interest rates and a noticeable reduction in Treasury purchases to counter the sharp rise in prices. Today’s focus will be on minute of the Fed policy meetingin March, which should disclose details of its likely plans to reduce the huge budget.

Meanwhile, the nervousness for the elections in France continues to grip investors. According to the economist of Abrdn, Pietro Baffico“Macron’s re-election would be welcomed by the financial marketsas it would imply political continuity, some further progress on the reform agenda, perhaps greater EU integration and a renewed attempt to tackle pension reform. “

On the currency market, theEuro / US dollar maintains its position substantially stable at 1.091. Slight drop ingold, which drops to $ 1,918.7 an ounce. Oil (Light Sweet Crude Oil), on the rise (+ 1.44%), reaches 103.4 dollars per barrel.

Slightly up spreadwhich is positioned at +166 basis points, with a timid increase of 3 basis points, with the yield of the 10-year BTP equal to 2.32%.

Among the markets of the Old Continent heavy Frankfurtwhich marks a drop of -1.78 percentage points, hesitates London, which yields 0.37%; negative session for Paris, which falls by 1.84%. Piazza Affari, with the FTSE MIB which accuses a reduction of 2%; on the same line, deep red for the FTSE Italia All-Sharewhich falls back to 26,692 points, a sharp decline of 1.99%.

Among the best Blue Chips of Piazza Affari, the utilities, defensive stocks, against the volatility and uncertainties of the markets are well set up: Snam, shows an increase of 1.67%. Toned Italgas which shows a nice advantage of 1.14%.

Small steps forward for Unipolwhich marks a marginal increase of 0.51%.

The strongest sales, on the other hand, show up on Stellantiswhich continues trading at -4.59%.

Sales focus on Nexiwhich suffers a decline of 4.40%.

Sales on CNH Industrialwhich recorded a decline of 4.29%.

Sensitive losses for STMicroelectronicsdown 3.55%.

Between best stocks in the FTSE MidCap, GVS (+ 1.69%) e Alerion Clean Power (+ 1.24%).

The strongest sales, on the other hand, show up on Brembowhich continues trading at -4.78%.

Breathless Datalogicwhich falls by 4.76%.

Thud of Mfe Bwhich shows a fall of 4.56%.

Letter on Biessewhich records an important decline of 4.40%.

Between macroeconomic quantities most important:

Wednesday 06/04/2022

02:45 China: PMI Caixin services (preceding 50.2 points)

08:00 Germany: Industry orders, monthly (expected -0.2%; previous 2.3%)

11:00 am European Union: Production prices, annual (expected 31.5%; previous 30.6%)

11:00 am European Union: Production prices, monthly (expected 1.3%; previous 5.1%)

16:30 USA: Oil stocks, weekly (expected -2.06 Mln barrels; prev. -3.45 Mln barrels).