(Finance) – Negative session for Piazza Affari, which closed down trades, in agreement with the other continental lists, which suffered substantial losses. Meanwhile, Wall Street continues its sharply lower trading, with theS & P-500 which fell 1.95%, on the day of the long-awaited speech by Federal Reserve Chairman Jerome Powell at the Jackson Hole Economic Symposium. The banker said we need to continue with rate hikes and that getting inflation under control will take “some time”.

On the currency market, theEuro / US dollar shows a timid gain, with a progress of 0.32%. Bad day forgold, which continues the session at $ 1,737.2 an ounce, down 1.18%. Session in fractional decline for oil (Light Sweet Crude Oil), which leaves, for now, 0.47% on the parterre.

Jump up it spreadpositioning itself at +230 basis points, with an increase of 7 basis points, with the yield of the ten-year BTP equal to 3.68%.

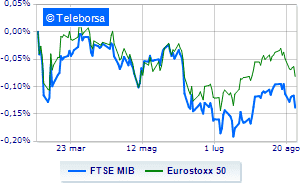

Among the Euroland indices goes down Frankfurtwith a decrease of 2.26%, sales up Londonwhich recorded a fall of 0.70%, and collapsed Paris, with a decrease of 1.68%. In Milan, a sharp decline in FTSE MIB (-2.49%), which reached 21,895 points, halting the series of three consecutive rises, which began last Tuesday; along the same line, the FTSE Italia All-Sharewhich closed the session at 23,948 points.

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 1.29 billion euro, a marked decrease (-13.75%), compared to the previous session which had seen the negotiation of 1.5 billion euro; while the volumes traded went from 0.51 billion shares of the previous session to today’s 0.41 billion.

In this bad day for Piazza Affari, no Blue Chip scores a positive performance.

The worst performances were recorded on Amplifonwhich closed at -6.02%.

Negative sitting for Nexiwhich shows a loss of 5.40%.

Sales hands on Ivecowhich suffers a decrease of 4.92%.

Bad performance for Monclerwhich recorded a decline of 4.92%.

Between best stocks in the FTSE MidCap, Datalogic (+ 2.75%), Alerion Clean Power (+ 2.47%), Saras (+ 2.07%) e Wiit (+ 1.29%).

Stronger sales, on the other hand, fell on GVSwhich ended trading at -4.87%.

Black session for OVSwhich leaves a loss of 4.57% on the table.

At a loss Secowhich falls by 3.95%.

Heavy Safilowhich marks a drop of -3.78 percentage points.

Among macroeconomic appointments which will have the greatest influence on market trends:

Friday 08/26/2022

08:45 France: Consumer confidence, monthly (expected 79 points; preceding 80 points)

10:00 European Union: M3, annual (expected 5.6%; previous 5.7%)

14:30 USA: Wholesale stocks, monthly (expected 1.4%; previous 1.8%)

14:30 USA: Personal expenses, monthly (expected 0.4%; previous 1%)

14:30 USA: Personal income, monthly (expected 0.6%; previous 0.7%).