(Tiper Stock Exchange) – Bad day for Piazza Affari and the other main European stock exchanges, with better-than-expected Eurozone PMI data in February failing to improve sentiment. After the rally at the beginning of the year, investors seem to be willing take profit in a more cautious climateahead of the new round of central bank meetings. Today Morgan Stanley said he expects a terminal rate at 3.25%, while Goldman Sachs at 3.50%.

Also, analysts are switching to less optimistic forecasts for European equities. “We remain positioned for one sharp loss of growth momentum in the coming months,” he said Bank of AmericaWhile JPMorgan Chase he explained that key monetary indicators are “sending warning signs”, such as shrinking money supply and an inverted yield curve pointing to a recession arriving.

At Piazza Affari they have 2022 data released Registerwhich presented a new plan that estimates a growing profit up to 580 million in 2025, and Campariwhich after a double-digit growth in sales in the past year has decided to leave the dividend unchanged for shareholders.

On the Euronext Growth Milan segment, keep on running Solid World Groupwhich a few days ago announced the start of production of Electrospider, the 3D bioprinter that replicates human tissue, with an initial capacity of 12 printers worth 500,000 euros each.

No significant change for theEuro / US Dollar, which trades on the previous day’s values of 1.067. Slight drop ingold, which drops to 1,832.6 dollars an ounce. Euphoric session for crude oil, with the petrolium (Light Sweet Crude Oil) showing a jump of 0.23%.

Small step to the top of the spreadswhich reaches +181 basis points, showing an increase of 3 basis points, with the yield of the 10-year BTP equal to 4.26%.

Among the European lists modest descent for Frankfurtwhich loses a small -0.28%, stops Londonwhich marks an almost nothing done, and thoughtfully Parisa fractional decline of 0.23%.

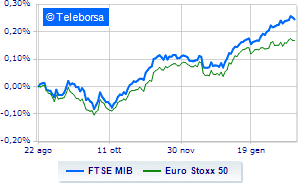

TO Milanmoves below parity the FTSEMIBwhich drops to 27,439 points, with a percentage gap of 0.57%: the main index of the Milan Stock Exchange thus continuing a negative series, which began last Friday, of three consecutive reductions; on the same line, it ranks below parity the FTSE Italia All-Share, which recedes to 29,677 points. Almost unchanged FTSE Italia Mid Cap (-0.08%); in fractional decline the FTSE Italy Star (-0.35%).

Between best Italian stocks large-cap, good performance for Leonardo, which grows by 3.37%. Composed A2A, which grows by a modest +0.98%. Modest performance for Italgas, which shows a moderate increase of 0.64%. Resistant Phinecuswhich marks a small increase of 0.61%.

The strongest declines, however, occur on Register, which continues the session with -3.11%. They focus their sales on Unicredit, which suffers a drop of 2.09%. Sales on Campari, which records a drop of 1.99%. Bad sitting for Nexiwhich shows a loss of 1.85%.

At the top among Italian stocks a mid-cap, Carel Industries (+2.55%), Alerion Clean Power (+1.93%), Banca Popolare di Sondrio (+1.81%) and Acea (+1.34%).

The strongest declines, however, occur on Fincantieri, which continues the session with -3.76%. Under pressure Antares Vision, which shows a drop of 3.73%. Slide Saras, with a clear disadvantage of 2.46%. In red Banca Ifiswhich shows a marked decrease of 2.10%.