(Tiper Stock Exchange) – Modest decrease for the Milan Stock Exchange, while the rest of Europe keeps its previous values. Meanwhile on Wall Street theS&P-500 marks an increase of 0.21%, where the focus of investors remains concentrated on central banks.

On the foreign exchange market, theEuro / US Dollar the session continued just below parity, with a drop of 0.31%. Caution prevails overgold, which continues the session with a slight drop of 0.35%. Oil (Light Sweet Crude Oil), up (+0.21%), reaches 71.44 dollars per barrel.

Downhill it spreadswhich retreats to +164 basis points, with a decrease of 5 basis points, while the 10-year BTP reports a yield of 4.02%.

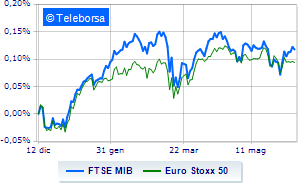

Among the indices of Euroland slow day for Frankfurtwhich marks a decline of 0.25%, small loss for London, which trades with -0.49%; stay close to parity Paris (-0.12%). The Milanese price list continues the session just below parity, with the FTSEMIB which cuts 0.41%, thus cutting off the bullish trail supported by three consecutive gains, which began last Tuesday; along the same lines, slightly down the FTSE Italia All-Sharewhich continues the day below parity at 29,282 points.

Among the best Blue Chips of Piazza Affari, ERG advances by 1.83%.

Sitting without momentum for Leonardoreflecting a moderate increase of 1.28%.

Small step forward for STMicroelectronicswhich shows a progress of 1.18%.

The strongest declines, however, occur on MPS Bank-10.80% after the chairman of Unipol, Cimbri, categorically excluded the hypothesis of merger with Bperof which the insurance group is the first shareholder.

Bad sitting for Saipemwhich shows a loss of 1.98%.

Under pressure BPERwhich shows a drop of 1.96%.

Slide Nexiwith a clear disadvantage of 1.86%.

Among the protagonists of the FTSE MidCap, MFE B (+5.92%), De Nora Industries (+5.53%), MFE A (+4.19%) and Saint Lawrence (+2.31%).

The worst performances, however, are recorded on Illimity Bankwhich gets -3.42%.

In red Alerion Clean Powerwhich shows a marked decrease of 1.67%.

He hesitates Rai Waywhich drops 1.46%.

Basically weak Carel Industrieswhich recorded a decrease of 1.45%.