(Finance) – In Europe, purchases are unleashed, as well as in Piazza Affari which shows an excellent performance, where the rally in bank stocks is highlighted. The focus of investors remains concentrated on central banks, where in addition to the Federal Reserve and to Bank of England was added, surprisingly, the ECB who has called, for today, a extraordinary meeting aimed at considering the recent market turbulence.

On the currency market, the surprise Eurotower meeting pushes theEuro / US dollar, which shows an increase of 0.59%. L’Gold trading continues at $ 1,827.8 an ounce, an increase of 1.10%. Light Sweet Crude Oil loses 0.79% and continues to trade at $ 118 per barrel the day after OPEC confirmed its forecast that global crude oil demand will exceed pre-pandemic levels in 2022. .

Excellent level of spreadwhich drops to +214 basis points, with a drop of 23 basis points, with the yield of the 10-year BTP reaching 3.81%.

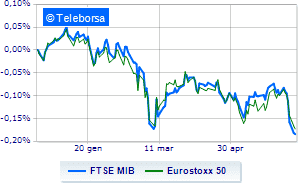

In the European stock market scenario moves into positive territory Frankfurtshowing an increase of 1.15%, money on London, which recorded an increase of 1.18%; definitely positive balance for Paris, which boasts a progress of 0.86%. Strong upside exchanges for the Milan stock exchange, with the FTSE MIB, which is posting a 2.91% gain, breaking the streak that began on the 7th of this month; along the same lines, the FTSE Italia All-Sharewhich with its + 2.79% advances to 24,541 points.

At the top of the ranking of the most important titles of Milan, we find Fineco (+ 7.21%), Intesa Sanpaolo (+ 6.26%), Banco BPM (+ 4.95%) e Generali Insurance (+ 4.90%).

The strongest sales, on the other hand, show up on Tenariswhich continues trading at -2.80%.

At the top among Italian stocks a mid cap, Banca Popolare di Sondrio (+ 4.82%), Fincantieri (+ 4.67%), Wiit (+ 3.98%) e Ferragamo (+ 3.93%).

The strongest sales, on the other hand, show up on Mfe Awhich continues trading at -2.67%.

Between the data relevant macroeconomics:

Wednesday 15/06/2022

01:50 Japan: Core machinery orders, monthly (expected -1.5%; previous 7.1%)

04:00 China: Industrial production, annual (expected -0.7%; previous -2.9%)

04:00 China: Retail sales, annual (expected -7.1%; previous -11.1%)

06:30 Japan: Services index, monthly (previous 1.3%)

08:45 France: Consumer prices, annual (expected 5.2%; previous 4.8%).