(Tiper Stock Exchange) – Piazza Affari does not budge from the previous valuesin line with the main Euroland markets, in a session characterized by the absence of cues from Wall Street, closed yesterday for the Thanksgiving holiday. American markets reopen today, but close early at 1pm New York time.

Investor focus remains on central banks after the ECB minutes showed a trend in favor of further hikes, compared to the slowdown forecast by Fed officials in the minutes of the last meeting of the US central bank in early November. However, the vice president of the Eurotower, de Guindos he said “the peak of inflation could be near”.

On the foreign exchange market, theEuro / US Dollar remains substantially stable at 1.042. Seat in fractional decline for thegold, which leaves 0.24% in the crowd for now. Oil (Light Sweet Crude Oil) continues the session up and advances to 78.92 dollars per barrel.

In decided rise it spreadswhich stands at +185 basis points, with a strong increase of 10 basis points, while the 10-year BTP shows a yield of 3.72%.

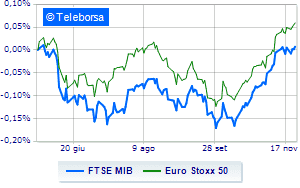

Among the European lists thoughtful Frankfurtwith a fractional drop of 0.32%, little moved London, which shows +0.12%; weak Paris, which reports a moderate -0.06%. Piazza Affari continues the session on the levels of the eve, reporting a variation of -0.09% on FTSEMIB.

At the top of the ranking of the most important titles of Milan, we find A2A (+2.01%), Hera (+0.83%), Italian post (+0.82%) and Ferrari (+0.57%).

The worst performances, however, are recorded on Saipemwhich gets -1.10%.

He hesitates Stellantiswith a modest decline of 0.96%.

Slow day for DiaSorinwhich marks a decline of 0.79%.

Small loss for Monclerwhich trades with -0.66%.

At the top of the mid-cap rankings from Milan, Mfe B (+2.70%), wiit (+2.33%), IREN (+2.00%) and Mondadori (+1.30%).

The strongest declines, however, occur on El.Enwhich continues the session with -1.70%.

They focus their sales on Italmobiliarewhich suffers a drop of 1.54%.

He hesitates GV extensionwhich drops 1.16%.

Basically weak Mortgages onlinewhich recorded a decrease of 1.10%.

Among the data relevant macroeconomics:

Friday 11/25/2022

08:00 Germany: GDP, quarterly (exp. 0.3%; previous 0.1%)

08:45 France: Consumer confidence, monthly (expected 83 points; previous 82 points)

9:00 am Spain: Production prices, annual (previous 35.6%)

Monday 11/28/2022

10am European Union: M3, annual (expected 6.1%; previous 6.3%)

Tuesday 11/29/2022

half past one Japan: Unemployment rate (previous 2.6%).