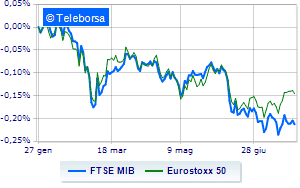

(Finance) – The Milan Stock Exchange closed in sharp declinewhile the main European stock exchanges are reducing more moderately, while awaiting the new rate hike from the Federal Reserve.

On the currency market, theEuro / US dollar it is down (-0.94%) and stands at 1.012. Substantially stable thegold, which continues the session on the eve of the levels of 1,718.3 dollars an ounce. Oil (Light Sweet Crude Oil) loses 1.29% and continues to trade at $ 95.45 per barrel.

Slight worsening of the spreadwhich rises to +237 basis points, with an increase of 4 basis points, with the yield of the 10-year BTP equal to 3.23%.

Among the Euroland indices they focus their sales on Frankfurtwhich suffers a decline of 0.86%, little moved Londonwhich shows a 0%, and a lackluster day for Paris, which marks a decline of 0.42%. Negative session for Piazza Affari, with the FTSE MIB which leaves 1.04% on the parterre, while, on the contrary, the FTSE Italia All-Share ends the day up by 0.73%.

From the closing figures for Milan, the turnover in today’s session was 1.49 billion euro, down (-9.99%) compared to the previous 1.66 billion; while the volumes traded went from 0.55 billion shares of the previous session to today’s 0.45 billion.

Among the best Blue Chips of Piazza Affari, purchases with both hands on Italgaswhich boasts an increase of 2.93%.

Good performance for Ternawhich grew by 1.94%.

Moderately positive day for Snamwhich rises by a fractional + 0.87%.

Sitting without momentum for Atlantiareflecting a moderate increase of 0.62%.

Stronger sales, on the other hand, fell on Monclerwhich ended trading at -4.56%.

Letter on Ivecowhich records a significant decline of 3.11%.

Goes down Banco BPMwith a decline of 3.10%.

Collapses Telecom Italiawith a decrease of 3.10%.

At the top among Italian stocks a mid cap, Saras (+ 2.47%), Pharmanutra (+ 1.71%), Bff Bank (+ 1.61%) e Ascopiave (+ 1.45%).

The strongest declines, on the other hand, occurred on OVSwhich closed the session at -5.43%.

Sales hands on Mfe Awhich suffers a decrease of 5.15%.

Bad performance for Ariston Holdingwhich recorded a decline of 4.21%.

Black session for Tod’swhich leaves a loss of 3.93% on the table.

Between the data relevant macroeconomics:

Tuesday 26/07/2022

9:00 am Spain: Production prices, annual (previous 43.6%)

15:00 USA: FHFA house price index, monthly (previous 1.5%)

15:00 USA: S&P Case-Shiller, annual (expected 20.6%; previous 21.2%)

4:00 pm USA: New house sales, monthly (previously 6.3%)

4:00 pm USA: Consumer confidence, monthly (97.2 points expected; previous 98.4 points).