(Finance) – In Europe, purchases are unleashed, as well as in Piazza Affari which shows an excellent performance. The sectors of banksofautomotive and of technology (with the respective sectoral FTSE Italia All-Share indices up by more than 7%), with the strong coverage following the collapses of last week. FTSE Italia All-Share is down Energythe only sector in the red, with the prices of Petroleum which drop below $ 125 a barrel. Investors find themselves weighing the US ban on Russian oil imports and Russia’s announcement of a new ceasefire in Ukraine for the evacuation of civilians.

L’Euro / US dollar trading continues with a fractional gain of 0.68%. Day to forget forgold, which trades at 2,016.4 dollars an ounce, retracing 1.61%. Oil (Light Sweet Crude Oil) collapsed by 3.07%, falling as low as $ 119.9 per barrel.

The Spread improves, reaching +143 basis points, with a decrease of 6 basis points compared to the previous value, with the yield of the ten-year BTP equal to 1.61%.

Among the Euroland indices takes off Frankfurtwith a major advance of 4.96%, in evidence Londonwhich shows a strong increase of 1.58%, and stands out Paris which marks an important progress of 4.61%.

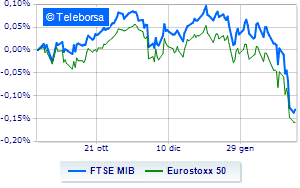

A day of strong earnings for Piazza Affari, with the FTSE MIB up by 4.94%; along the same lines, the FTSE Italia All-Sharewhich with its + 4.96% advances to 25,583 points.

High on the FTSE Italia Mid Cap (+ 5.09%); on the same trend, effervescent the FTSE Italia Star (+ 4.2%).

Between best Italian stocks large cap, fly Stellantiswith a marked rise of 9.74%.

It shines Unicreditwith a strong increase (+ 9.22%).

Excellent performance for STMicroelectronicswhich records an increase of 8.67%.

Exploit of Mediolanum Bankwhich shows an increase of 8.57%.

The strongest falls, on the other hand, occur on Tenariswhich continues the session with -3.23%.

Breathless Saipemwhich falls by 3.07%.

Decline for Leonardowhich marks a -1.97%.

Under pressure ENIwith a sharp decline of 1.21%.

Top of the ranking of mid-cap stocks from Milan, Ferragamo (+ 11.52%), El.En (+ 10.04%), Unieuro (+ 8.43%) e Saint Lawrence (+ 8.42%).

Between the data relevant macroeconomics:

Wednesday 09/03/2022

01:50 Japan: GDP, quarterly (expected 1.4%; previous -0.7%)

02:30 China: Consumption prices, annual (expected 0.9%; previous 0.9%)

02:30 China: Production prices, annual (expected 8.7%; previous 9.1%)

07:30 France: Employment, quarterly (previous 0.5%)

10:00 Italy: Industrial production, monthly (expected 0%; previous -1.1%).