(Finance) – In Europe, purchases are unleashedas well as in Piazza Affari which shows an excellent performance, driven by banking, energy and automotive stocks. The rumors that emerged after the ECB meeting, according to which some members would be in favor of another hike from 75 basis points in October, are holding on. The “hawkish” signals, including the words of Joachim Nagel, also push the trend of the euro.

On the macroeconomic front, the Italian industrial production marks a marginal recovery in July (after two months of decline), even if the cyclical dynamics in the average of the last quarter remain negative. UK GDP grows less than expected in July, with industrial production disappointing analysts.

Decisive rise inEuro / US dollar (+ 1.55%), which reaches 1.02. Slight increase forgold, which shows an increase of 0.46%. Plus sign for the Petroleum (Light Sweet Crude Oil), up 0.79%.

Unchanged it spreadwhich is positioned at +230 basis points, with the yield of Ten-year BTP which stands at 3.99%.

In the European stock market scenario shines Frankfurtwith a strong increase (+ 1.63%), sustained Londonwith a decent gain of 1.25%, and good insights on Pariswhich shows a large 1.32% lead.

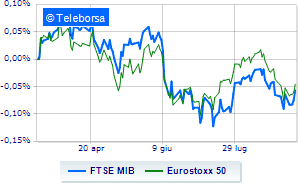

Strong earnings day for Business Squarewith the FTSE MIB up 1.84%, continuing the series of five consecutive increases that began last Tuesday; on the same line, brilliant day for the FTSE Italia All-Sharewhich advances to 24,500 points.

Positive the FTSE Italia Mid Cap (+ 1.28%); on the same line, in cash the FTSE Italia Star (+ 0.7%).

Between best Italian stocks large cap, excellent performance for BPERwhich recorded a progress of 6.04%.

Exploit of Saipemwhich shows an increase of 5.81%.

High Fineco (+ 3.88%).

Shopping hands-on Mediolanum Bankwhich boasts an increase of 3.78%.

At the top among Italian stocks a mid cap, MPS Bank (+ 18.26%), Banca Ifis (+ 4.28%), Anima Holding (+ 3.34%) e Seco (+ 3.00%).

The strongest falls, on the other hand, occur on Carel Industrieswhich continues the session with -1.65%.

Suffers Antares Visionwhich shows a loss of 1.11%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Monday 12/09/2022

08:00 United Kingdom: Industrial production, monthly (expected 0.4%; previous -0.9%)

08:00 United Kingdom: Industrial production, annual (expected 1.9%; previous 2.4%)

10:00 Italy: Industrial production, annual (expected -0.4%; previous -1.1%)

10:00 Italy: Industrial production, monthly (expected 0.3%; previous -2%)

Tuesday 13/09/2022

01:50 Japan: Production prices, monthly (expected 0.4%; previous 0.9%).