(Tiper Stock Exchange) – The Milan Stock Exchange moved little, which is not in line with the upward trend of the other stock exchanges in Euroland. On the American market there has been considerable progress for theS&P-500, after the inflation data, published the day before, which confirms the slowdown in producer prices. Unemployment benefits, on the other hand, reiterate the difficulties of the labor market, showing a rise to the highest levels since mid-January. Investor attention is focused on the upcoming central banks. The Fed, in its minutes, spoke of a possible mild recession in 2023.

On the foreign exchange market, a slight increase forEuro / US Dollar, which shows an increase of 0.59%. plus sign forgold, which shows an increase of 1.32%. Oil (Light Sweet Crude Oil) fell fractionally, leaving 0.48% on the fence for now.

Consolidate the levels of the eve lo spreadssettling at +181 basis points, with the yield on the ten-year BTP standing at 4.15%.

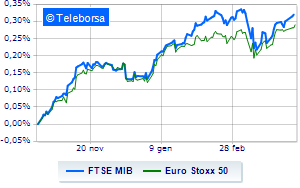

Among the main European Stock Exchanges flat Frankfurtwhich holds parity, composed London, which grows by a modest +0.24%; well set Paris, which shows an increase of 1.13%. Basically stable Piazza Affari, which continues the session at the levels of the eve, with the FTSEMIB which stops at 27,626 points; on the same line, remains at the starting line the FTSE Italia All-Share (Business Square), which stands at 29,829 points, close to the previous levels.

Between best Italian stocks large-cap, strong performance for Monclerwhich records an increase of 4.45%.

Toned Leonardo which shows a nice advantage of 3.21%.

In light amplifierwith a large progress of 2.50%.

Positive trend for Nexiwhich rises by a fair +2.09%.

The worst performances, however, are recorded on Is in thewhich gets -3.92%.

Under pressure Phinecuswhich shows a drop of 1.70%.

Slide General Bankwith a clear disadvantage of 1.66%.

In red Triadwhich shows a marked decrease of 1.64%.

Among the protagonists of the FTSE MidCap, Maire Tecnimont (+3.21%), Tod’s (+2.98%), Technogym (+2.86%) and Banca Ifis (+2.46%).

The worst performances, however, are recorded on Drywhich gets -2.40%.

Slack believewhich shows a small decrease of 1.02%.

Modest descent for MARRwhich drops a small -1.02%.

Thoughtful Cembrea fractional decline of 1.00%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Thursday 13/04/2023

08:00 Germany: Consumption prices, annual (expected 7.4%; previous 8.7%)

08:00 Germany: Consumption prices, monthly (expected 0.8%; previous 0.8%)

08:00 United Kingdom: Industrial Production, Monthly (exp. 0.2%; previous -0.5%)

08:00 United Kingdom: Industrial Production, YoY (exp. -3.7%; previous -3.2%)

10am Italy: Industrial Production, Monthly (0.5% expected; previous -0.5%).