(Finance) – Strong drop for Estee Lauderwhich trades at a loss of 4.52% on the previous values.

The cosmetics group has worsened the outlook due to the evolution of the pandemic in China and the war in Ukraine. Adjusted earnings per share are now expected to be between $ 7.05 and $ 7.15 versus the $ 7.43-7.58 range previously indicated. of the previous one

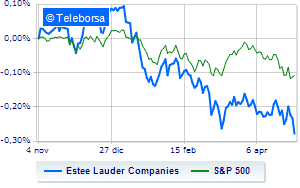

The trend of the leading company in anti-aging treatments in the week, compared toS & P-500notes a lower relative strength of the stock, which could fall prey to sellers ready to take advantage of potential weaknesses.

The technical status of Estee Lauder shows signs of worsening with support area set at USD 234.3, while on the upside the resistance area is identified at 257.7. For the next session we could see a new bearish moment with a target likely estimated at 219.8.