(Finance) – EssilorLuxottica closes the 2021 financial year with a revenue up by 23.7% to 17.8 billion euros, while net profit jumped to around 2.26 billion, 152.9% more than the 868 million made in 2020.

Proposed a dividend equal to € 2.51 per share.

In the period 2022-2026 the company indicates a growth of revenue around 5% per year and a adjusted operating profit to 19-20% of turnover in 2026.

In the meantime, the title is in Piazza Affari Essilor it is posting a 2.79% rise.

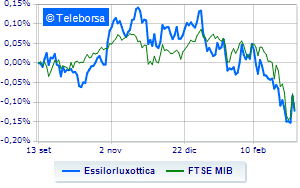

Comparing the performance of the stock with the FTSE MIBon a weekly basis, it is noted that the manufacturer of lenses and ophthalmic equipment maintains positive relative strength in comparison with the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance + 2.08%, compared to -3.65% of the main index of the Milan Stock Exchange).

The medium-term technical status of Essilor reiterates the negative trendline. However, analyzing the short-term chart, a less intense trend of the bearish line is highlighted, which could favor a positive development of the curve towards the resistance area identified at 154.3 Euro. Any bullish cues support the top target at 157.9, while the first support is estimated at 150.7.