(Finance) – It moves sharply up ePricewhich changed hands exceeding the previous values by 14.59%.

Assisting the shares is the news that the Board of Directors has approved the signing of a binding proposal received from Negma Group which confirms the interest in re-capitalizing and financing the company as well as transforming it into an investment company.

The necessary resources that will make it possible to resolve the situation would be disbursed in favor of Eprice through the use of a convertible bond loan to be issued in one or more tranches, with the exclusion of the option right, in favor of Negma on the basis of what has already been approved by the shareholders’ meeting on 27 April 2021, increased in the amount up to a maximum of Euro 20-22 million.

Negma expects to remedy the situation by the end of the current year 2022, by converting the bonds within the same period.

The Proposal provides for the granting of an exclusivity period until March 15, 2022 aimed at preparing the definitive agreement and verifying the fulfillment of certain conditions precedent, including the start of the process of preparing the listing prospectus and a business plan based on the guidelines indicated in the Proposal, as well as the approval of the 2020 financial statements and the start of the process of preparing the 2021 financial statements. Negma also makes it a condition that the Company maintains its listed status.

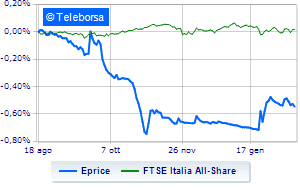

On a weekly basis, the stock’s trend is firmer than the FTSE Italia All-Share. At the moment, therefore, the appeal of investors is directed more decisively to theleading Italian e-Commerce company compared to the reference index.

The medium-term scenario is always positively connoted, while the short-term structure shows some yielding, as read by the relative indicators, due to the opposition of the resistance estimated at 0.0342 Euro. The control of the short-term situation offered by the supports at 0.03 is functional. There is a concrete possibility of a continuation of the corrective phase towards 0.0278.