(Tiper Stock Exchange) – Eni communicated that in the coming days will launch the second tranche of the treasury share buyback programmewhich follows the first tranche of purchases carried out between 12 May and 24 August 2023, where 62 million shares were purchased for 825 million euros.

The maximum number of shares ordinary to be purchased during the Second Tranche, which will have a maximum duration until April 2024, will be equal to 275 million (about 8% of the share capital) for maximum of 1.375 billion euros.

The purpose of this tranche is to give Eni shareholders additional remuneration with respect to the distribution of dividends, therefore, the treasury shares purchased will be canceled without reducing the share capital.

As indicated in the Capital Markets Update of February 23, 2023, Eni confirms its buyback program for a total amount of 2.2 billion euros by the end of April 2024.

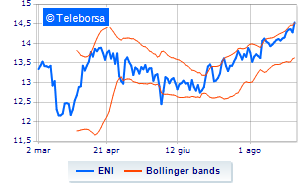

In Piazza Affari, today, a new bullish cue for the Six-Legged Dog Societywhich earns well and brings home +1.78%.