(Finance) – Eni announced that he had purchasedbetween 30 October and 3 November 2023, as part of the second tranche of the buyback programme, in total 5,155,269 treasury shares (equal to 0.15% of the share capital), at the weighted average price of 15.5002 euros per share, for a countervalue equal to 79,907,905.47 euros.

Starting from the start of the second tranche of the buyback program, Eni purchased 35,939,166 own shares (equal to 1.06% of the share capital) for a total value of 546,427,223.20 euros.

Considering the treasury shares already in portfolio, the cancellation of 195,550,084 treasury shares resolved by the Shareholders’ Meeting on May 10, 2023 and the purchases made since the start of the buyback program, Eni holds 126,160,238 treasury shares equal to 3.74% of the share capital.

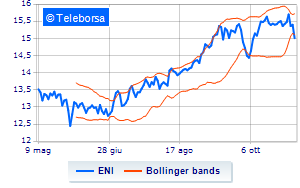

In the meantime, on the Milanese list, the Six-legged dog society it moves downwards and is positioned at 14.9 euros, with a drop of 0.77%.