(Finance) – Propeller announced that July 7, 2022 was completed the first part of the Buyback program of ordinary shares, communicated on March 16, 2022 and launched on March 21, 2022, in execution of the resolution of the Shareholders’ Meeting of April 29, 2021.

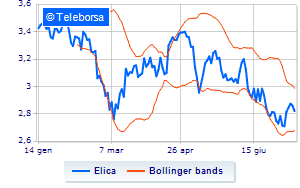

Between March 21 and July 7, 2022 Elica acquired and holds a total of 325,000 ordinary shares (equal to 0.51% of the share capital), for an equivalent value of 1,010,780 euros and a weighted average price for the volume of 3, 11 euros.

On July 11, 2022, the Company has the second tranche of the buy-back program launchedas authorized by the Shareholders ‘Meeting of April 28, 2022. In execution of the shareholders’ resolution, the second tranche will be launched starting from July 11, 2022 and until January 11, 2023, for a maximum number of treasury shares that can be purchased of 325,000 shares (equal to approximately 0.51% of the subscribed and paid-up share capital).

The Buyback Plan pursues the following purposes:

a) to execute possible future share incentive plans that may be authorized in favor of directors and / or employees and / or collaborators of the Company and / or its subsidiaries, in compliance with the provisions of the law;

b) to conclude agreements with individual directors, employees and / or collaborators of the Company or its subsidiaries, which are not included in the free share allocation plans;

c) intervene, where necessary and in compliance with the provisions in force, directly or through authorized intermediaries, with the aim of containing anomalous movements in the price of the Company’s shares and / or to regularize the trend of trading and prices;

d) make investments in treasury shares in pursuit of the Company’s strategic guidelines (e.g. using them as consideration, including in the case of the exchange of securities, for the purchase of shareholdings or in the acquisition of other companies), where market conditions make these transactions economically convenient;

e) use the treasury shares for operations such as the sale, contribution, assignment, exchange or other deed of disposal in the context of agreements with strategic partners, or to serve any extraordinary finance operations (eg convertible loans);

f) use treasury shares as collateral for loans.

For the implementation of the second tranche of the Buyback Plan, Elica has resolved to appoint Intermonte SIM as a specialized intermediary who will take decisions regarding purchases in full independence, also in relation to the timing of the transactions.

In Piazza Affari, today, discount for Propellerwhich closed the session with a decrease of 1.40%.