(Finance) – It moves at a loss EDF showing a decrease of 2.25% on the previous values.

The further cut in forecasts for the current year announced by the largest energy producer and distributor in France weighs on the shares. Électricité de France (EDF) has made it known that it is revising its own downwards gross operating margin (Ebitda) of 22.2 billion euros.

The Group maintains its forecasts on net financial debt at the end of 2023 equal to 3 times the gross operating merger, while the adjusted financial debt will be between 4.5 and 5 times the adjusted EBITDA.

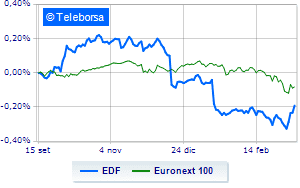

On a weekly basis, the stock’s trend is more solid than that of theEuronext 100. At the moment, therefore, the appeal of investors is directed more decisively to theFrench utility compared to the reference index.

Technically, EDF it is in a strengthening phase with an area of resistance seen at € 8.739, while the most immediate support is seen at 8.377. At the operational level, the session is expected to continue under the banner of bull with resistance seen at 9.1.