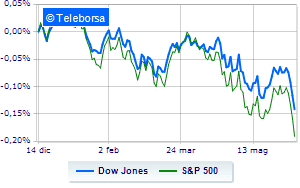

(Finance) – Sales rain on the US price listwhich trades with a heavy decline of 2.32%: the Dow Jones thus continues a negative series, which began last Wednesday, of four consecutive declines; on the same line, theS & P-500 it collapsed by 3.14%, down to 3,778 points. In sharp decline the Nasdaq 100 (-3.64%); as well, heavy theS&P 100 (-3.02%). THE inflation data on Fridays (above expectations and at their highest since 1981) pushed investors to price increases in interest rates higher and an increase of 75 basis points in the meeting of June 15 is not excluded.

Meanwhile, with today’s decline the S&P 500 should enter the “bear market” (or bear market), a phase characterized by a progressive decrease in the prices of financial assets and pessimistic expectations. The S&P 500 is down more than 20% from the record reached on January 3, 2022, which is generally associated with a bear market.

Strong nervousness and generalized losses in the S&P 500 on all sectors, without any exclusion. Among the worst on the list of the S&P 500, the sectors showed the greatest decline power (-4.48%), secondary consumer goods (-4.36%) e materials (-3.48%).

Among the best Blue Chips of the Dow Jones, McDonald’s (+ 0.61%) e Coke (+ 0.54%).

The worst performances, on the other hand, are recorded on Boeingwhich gets -8.54%.

Collapses Salesforcewith a decrease of 5.95%.

Sales hands on DOWwhich suffers a decrease of 5.08%.

Bad performance for Nikewhich recorded a decline of 4.05%.

Minus sign for all stocks on the Nasdaq 100, which moved into negative territory.

The strongest falls occur on Docusignwhich continues the session with -10.98%.

Black session for Pinduoduo Inc Spon Each Repwhich leaves a loss of 9.69% on the table.

At a loss Mercadolibrewhich falls by 9.60%.

Heavy Splunkwhich marks a drop of as much as -9.03 percentage points.

Between the data relevant macroeconomics on US markets:

Tuesday 14/06/2022

14:30 USA: Production prices, monthly (expected 0.8%; previous 0.5%)

14:30 USA: Production prices, annual (expected 10.9%; previous 11%)

Wednesday 15/06/2022

14:30 USA: Empire State Index (expected 4.5 points; previous -11.6 points)

14:30 USA: Export prices, monthly (expected 1.4%; previous 0.6%)

14:30 USA: Retail sales, annual (previous 8.2%).