(Finance) – The Wall Street stock market moves down in a climate of persistent volatility, with investors worried about economic growth and interest rate hikes linked to high inflation.

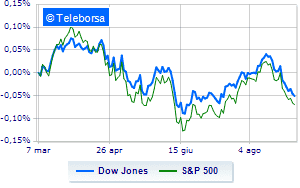

Among the US indices, the Dow Jones, which drops to 31,107 points, with a percentage difference of 0.68%; along the same lines, a slight decrease inS & P-500, which continues the day below par at 3,901 points. Downhill the Nasdaq 100 (-0.9%); as well, in fractional decline theS&P 100 (-0.67%).

Strong nervousness and generalized losses in the S&P 500 across all sectors, without exclusion. In the list, the worst performances are those of the sectors telecommunications (-1.55%), power (-1.16%) e informatics (-0.81%).

Unique among the Blue Chips of the Dow Jones to report a significant increase is Johnson & Johnson (+ 0.84%).

The worst performances, on the other hand, are recorded on 3Mwhich gets -3.24%.

Negative sitting for Intelwhich falls by 2.24%.

Sensitive losses for Goldman Sachsdown 2.08%.

It slips Walt Disneywith a clear disadvantage of 1.65%.

To the top between tech giants of Wall Streetthey position themselves Lululemon Athletica (+ 3.49%), Illuminate (+ 2.52%), Fiserv (+ 2.51%) e Fortinet (+ 1.67%).

The worst performances, on the other hand, are recorded on Pinduoduo Inc Spon Each Repwhich gets -7.67%.

Breathless Modernwhich fell by 5.41%.

Thud of Oktawhich shows a fall of 5.21%.

Letter on Datadogwhich recorded a significant decline of 3.92%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 06/09/2022

15:45 USA: Composite PMI (expected 45 points; preceding 47.7 points)

15:45 USA: PMI services (expected 44.3 points; preceding 47.3 points)

4:00 pm USA: Non-manufacturing ISM (expected 55.1 points; previous 56.7 points)

Wednesday 07/09/2022

14:30 USA: Balance of trade (expected -70.3 B $; previously -79.6 B $)

Thursday 08/09/2022

14:30 USA: Unemployment Claims, Weekly (240K units expected; previously 232K units).