(Tiper Stock Exchange) – Wall Street is moving negativelyfollowing recent hikes on prospects that moderating inflation could lead the Federal Reserve to be less aggressive in its upcoming interest rate hikes. “As the inflationary picture improves, market participants have speculated that a spring rate spike will give way to rate cuts starting in the third quarter,” said Mark Dowding, CIO at BlueBay. continue to reject this hypothesis and, given that economic activity remains quite healthy As we enter the new year, we believe some of these more dovish projections may be underwhelmed.”

Meanwhile, important indications on the trend of the economy have come from quarterly reports of US financial giants, the first to report results in the quarterly season. In particular, he was concerned about the warning of JPMorganaccording to which there has been a “modest deterioration in the company’s macroeconomic outlook, which now reflects a slight recession in the central scenario“.

Bank of America reported above-expected earnings as rising interest rates dragged down net interest margin (NII). JPMorgan reported growing quarterly earnings on strong trading activity. Wells Fargo reported quarterly earnings down 50% and provisions increased. Citigroup reported lower quarterly earnings, while trading (especially in fixed income) bucked the trend.

BlackRockthe world’s largest fund manager, reported declining profits in the fourth quarter of 2022, while assets under management (INCREASE) stood at $8.59 trillion.

Among others corporate announcements, Delta Air Lines (a major U.S. airline) reported fourth-quarter 2022 earnings above expectations, with the CEO noting that “the industry backdrop for air travel remains supportive.” The fast food chain Wendy’s announced that CFO Leigh Burnside and chief commercial officer Kurt Kane will leave the company.

As regards the analyst recommendationsGoldman Sachs cut its rating on Lockheed Martin to sell from neutral (target price at $56 from $332), underlining that the stock is vulnerable to any change in the state budget. Guggenheim sold from neutral up Tesladue to concerns about Tesla’s fourth-quarter estimates.

Salesforce was downgraded from Atlantic Equities to neutral from overweight, due to execution issues, management exodus and slower-than-expected revenue growth. Bank of America has updated its rating on Caterpillar a buy from neutral, saying the company has an undervalued roadmap that can drive outperformance.

On the macroeconomic front, they moved in a contrasting way i import-export prices USA in December 2022. The index is also under observation consumer confidence of the University of Michigan, which conducts a monthly survey of financial conditions and household attitudes towards the economy.

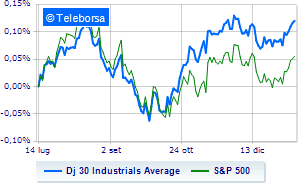

Wall Street moves fractionally lower, with the Dow Jones which is leaving 0.66% on the fence, thus cutting off the bullish trail supported by three consecutive gains, which began last Tuesday; along the same lines, theS&P-500, which retreats to 3,949 points, retracing by 0.85%. Negative the NASDAQ 100 (-0.85%); with analogous direction, negative variations for theS&P 100 (-0.85%).