(Finance) – Pressure on Dollar Generalwhich fell 8.07% after the discount retailer cut its full-year earnings forecast.

During the third quarter, the company experienced unexpected delays in acquiring additional temporary warehouse space sufficient for its inventory needs, which caused inefficiencies within its internal supply chain. at higher-than-expected supply chain costs.”

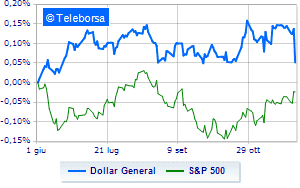

The weekly analysis of the stock compared to theS&P-500 shows a decrease relative to the index in terms of relative strength of Dollar Generalwhich does worse than the reference market.

The short-term analysis of Dollar General highlights a marginally positive trend with immediate resistance area identified at USD 239.8 and support at 230.5. This trendline anticipates a possible further upward extension of the curve at the test of the 249.1 level.