The years of loose monetary policy and zero interest rates are coming to an end. As a result, Italy’s debt situation is once again a matter of concern.

17:02 • Updated 5:07 PM

Is the Italian economy sustainable?

This issue is now being considered by both investors and policy makers. The reason is that the years of loose monetary policy and zero interest rates that have been going on for years are coming to an end. Interest rates, and with it debt management costs, are rising, which is hitting the most heavily indebted countries in particular – Italy, the EU’s third largest economy.

Chief Analyst at Nordea Banking Group Jan von Gerichin considers that the situation in Italy is a matter of concern.

– The moderate increase in interest rates previously forecast would have been sustainable. Given the situation in Italy and how fast interest rates are now rising, there is a real risk that Italy will face major challenges.

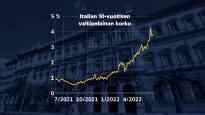

The interest rate on Italy’s ten-year government bond has been rising during the spring and early summer. The rise in government interest rates indicates that the market is worried about Italy’s ability to pay its debts. Last week, the interest rate exceeded four per cent, which is only a few percentage points away from the six per cent limit considered critical.

In the worst case scenario, a new euro crisis may lie ahead, with other eurozone countries having to bail out Italy, which is collapsing under the debt burden in one way or another. According to Von Gerich, the possibility of a new euro crisis “cannot be ruled out”.

– It’s a risk scenario.

Interest rates on ten-year government bonds in Greece, Italy and Spain, which were considered troubled by the euro crisis in the early 2010s, would also skyrocket. Greece was unable to pay its debts at the time, and the euro countries and the International Monetary Fund came with aid packages to help it. Other eurozone countries, such as Portugal and Spain, also received aid packages after Greece.

The European Central Bank is between wood and bark

The ECB is in a difficult position to tighten monetary policy. It has a responsibility to maintain price stability, that is, to ensure that inflation does not get out of hand. It seeks to curb record-high inflation by raising policy rates and pushing down its large purchasing programs.

At the same time, however, the support of the most indebted eurozone countries has also remained on the shoulders of the ECB, says a doctoral researcher at the University of Helsinki. Antti Ronkainen.

– The instruments created by the eurozone countries after the euro crisis are insufficient to support Italy in this situation. It is actually entirely the responsibility of the European Central Bank, Ronkainen says.

Last week, the ECB announced that it would speed up the development of a program to alleviate the situation in the most indebted countries. In the ECB’s words, this is a so-called anti-fragmentation instrument. The ECB wants to prevent euro area government bond yields from evolving at different rates. The development of the interest rate on the Italian government bond in relation to the interest rate on the largest EU economy, the German government bond, is particularly closely monitored.

As news of the extraordinary meeting spread, the market calmed down slightly and this week the interest rate on Italy’s ten-year government bond has fallen from its peak. The spread on German government bond yields has also narrowed this week.

– I can’t believe that [markkinoiden] calm continues. Markets want to see what the central bank is ready for and concrete action is needed to bring about a more lasting calm, von Gerich says.

– I expect that there will continue to be big fluctuations here and this will not be solved with a single announcement.

According to researcher Antti Ronkainen, the ECB will have a difficult task in creating a new program. The ECB’s rules do not allow it to finance individual euro area countries.

– It may be very difficult for the European Central Bank to create an instrument that is effective in allaying the concerns of Italy and Greece, but which is at the same time in line with its mandate and legal.

Further information on the new tool is expected at the July or September meeting of the Governing Council.

The situation in Italy also affects Finns

According to chief analyst Jan von Gerich, the debt situation in Italy affects Finns in many ways.

– If the situation gets into crisis, then uncertainty will be reflected in the outlook for the euro area. The outlook for the eurozone is again of great importance to the Finnish economy, von Gerich says.

He estimates that the various common support mechanisms for the eurozone countries, as well as the recovery fund created by the pandemic, are likely to be more strongly involved in the debate when considering how to stabilize the debt market.

The big question is also how well Italy is succeeding in carrying out structural reforms that will convince investors of the country’s solvency. Italy gets the biggest pot from the EU’s common recovery fund. The country’s tax system is to be reformed, as is the Italian legal system.

The Italian Prime Minister is currently the former President of the ECB Mario Draghi. His leadership has had a calming effect on the market. Parliamentary elections will be held in Italy next year.

The topic can be discussed on June 23. until 11 p.m.