Have you received withholding tax in the declaration in 2025? News24 has talked to the “Luxury Trap” expert as well as economist Magdalena Kowalczyk on how to best tackle the tax loss.

Since 2006-in 36 seasons-the “Luxury Trap” has rolled in the TV box. During those years, countless Swedes, who ended up in financial trouble, have been assisted by the program’s experts.

Debberg has been tackled, possessions have been sold off and loans have been negotiated. But much has also happened during the nearly 20 years that the program was sent – something that Magnus Hedbergone of the “luxury trap” program leaders, previously told about News24.

– It may not be a huge difference from one season to another, but if you look five seasons back then much has happened. It is a slightly different type of loan market. It is also different what the people strive for, some other ideals. And that is constantly adjusted. Somewhere the luxury trap hangs with the development of society. You see that bit by bit. Season for season is updated.

Read more: The hosts about the change in the new luxury trap: “Different”

Don’t miss: Luxury trap-Magdalena: Here is the worst excuse among the participants

As is well known, many Swedish households have been faced with new financial challenges, with expensive foods, rampant electricity prices and mortgage rates that have gone away. It is also something that is marked in the “Luxury Trap”.

– There are more people knocking on the door of the Luxury trap now than before. Private finance and money are always a current topic, but there has been much more talk about money now in workplaces and at lunch tables, Hedberg has previously told to Express.

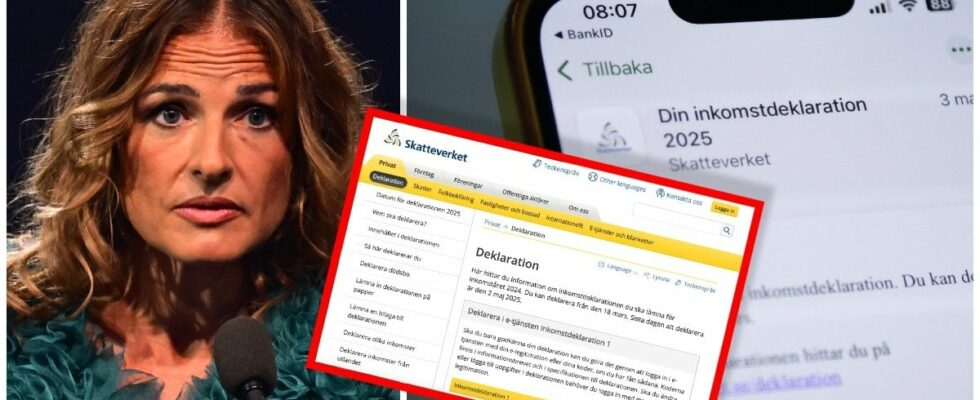

Luxury trap-Magdalena: Do this if you received withholding tax 2025

Right now there are also declaration times, which means that some will receive an extra supplement in the wallet in the form of tax refund, while others will have to pay withholding tax.

The latter may, for example, be the case if your employer has deducted too little tax during the past year.

Read more: Declaration 2025: Important dates to know

Don’t miss: Not received your declaration in 2025? This is why

So what should you really do if you suffer from an unexpectedly large tax bang? News24 asked Magdalena Kowalczyk As since 2018, Magnus Hedberg’s company as an expert in the “Luxury Trap”.

– Now it is important not to panic. Those money must in some way, she notes and continues:

– First and foremost, now the expenses must be strangled. Fimp streaming services, outdoor lunches and all kinds of shopping. Sell all that is in the wind that you do not use. Great cleaning and money in at once – double profit!

Read more: Change in the declaration 2025 – then you may be forced to pay

Kowalczyk further proposes negotiating any mortgages or even changing the bank if it saves a thousand dollars.

– Ultimately, if you have some stock or fund placements you may need to sell a little to be able to repay the residual tax.

Don’t miss: Sold something? You have to report this in the Declaration 2025

Read more: News Today – Current news from Sweden and the world

Don’t miss: Latest news – take part in what is happening right now