To diversify your assets, you don’t need to look far. Sometimes it is enough to explore the list of units of account (CU) accessible within your life insurance. Indeed, certain contracts – particularly those marketed on the Internet or by wealth management advisors – are full of investment supports going well beyond the euro fund. Certainly, these UC do not offer any capital guarantee, but they allow you to bet on more dynamic asset categories, such as the actions And the obligations. Their variety is such that we find both core portfolio investments and niche products, more original or, quite simply, unknown to savers.

NEW3789CT Five original and promising units of account

© / The Express

Before getting started, you must of course check the risk level of each UC and, based on this criterion, invest a reasonable amount in it. Do not put the same percentage of your portfolio in a European large-cap vehicle as in another targeting only metaverse companies! Investing through life insurance also has a reassuring element: before being referenced, the CUs are scrutinized by the companies, validating not their capacity to deliver performance but, at a minimum, their seriousness and the solidity of their manager. Here are five categories to explore to add a little pep to your contract.

Raw materials and precious metals

It remains difficult to access this category of assets within the insurance envelope. However, gold is popular with savers and, to gain exposure to its dynamics, there are equity products. But the latter target gold mining operators. Their link with the evolution of the price of gold itself is obvious, but the performance of these funds depends on many other factors, such as extraction costs, company governance, debt, etc.

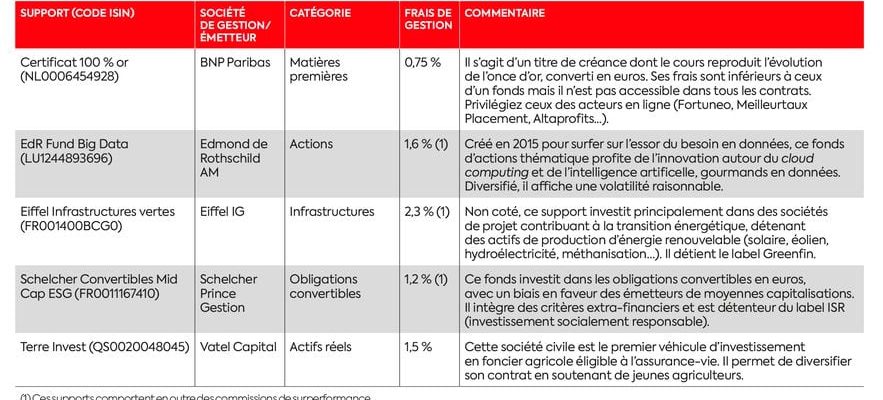

We will nevertheless note the existence of some good offers in this area, such as the R-co Thematic Gold Mining from Rothschild & Co AM or the CM-AM Global Gold from Crédit Mutuel AM. For a more direct approach, Ofi Precious Metals provides exposure to a set of four precious metals (gold, silver, platinum and palladium). More rarely, certain contracts reference “gold” certificates, which perfectly replicate the evolution of the price of the latter. It is also possible to find vehicles to gain broader exposure to commodities (agricultural products, metals, energy), but they are uncommon in general public contracts. Examples include the Lyxor Commodities Refinitiv/CoreCommodity CRB ETF (Amundi AM) index fund or the BNP Paribas Flexi I Commodities (BNP Paribas AM).

Agriculture and agri-food

Forests and agricultural land are on the rise, but it remains complex to find supports eligible for life insurance in this area. On the forest side, it is preferable to buy plots directly or via land groups, which benefit from specific tax advantages. However, since the summer of 2022, the management company Vatel Capital has created an original UC to bet on agricultural land. The civil society Terres Invest acquires land to rent it to young farmers over the long term. It “thus allows investors to contribute to the sustainable development of rural areas in France from an economic, social and environmental point of view”, claims the company. The target yield is 2.5%, to which are added the prospects of revaluation of land prices, to an equivalent level.

To find another solution, we must turn to the agri-food sector with, for example, DWS Global Agribusiness (DWS), which selects actions across the entire sector, from seeds to supermarkets.

Convertible bonds

Unloved by the general public, convertible bonds nevertheless have serious advantages. Like all bonds, they are debt securities issued by a company, with a repayment date and an interest rate. But the investor can also convert it into shares of the issuing company, according to a parity determined at creation. For example, if the company’s stock is worth 100 euros when the convertible bond is created, the conversion price will be set at 120, which only makes the operation interesting if the stock progresses even further. Beyond this level, you benefit from the entire increase, with no ceiling. This is the principle: if the share price changes little, we only benefit from the bond dimension. If it rises, you can convert the bond and benefit from the increase.

In exchange for this opportunity, the convertible pays a little less than a traditional bond. On the other hand, these securities therefore behave partly like debt and partly like shares. They therefore allow their holders to benefit from the performance of the stock market while protecting them against a drop in prices. Of course, it is advisable to use collective vehicles to avoid complex selection work. Opt for Schelcher Convertible Mid Cap ESG (Schelcher Prince Gestion), Ofi Invest ESG Convertible Europe (Ofi Invest AM), or even CM-AM Convertibles Euro (Crédit Mutuel AM).

New themes

To identify promising themes, managers rely on long-term trends that are shaping the world, such as demographic growth, the rise of the middle class in emerging countries, or even the digitalization of the economy. It is from this analysis that they determine the “good” areas in which to invest. A priori, the companies linked to it will benefit from interesting growth potential for the years to come. As a result, the themes cannot be multiplied infinitely. However, year after year, the managers manage to enrich the offer. Thus, beyond the well-established areas around the aging of the population, water management or technology, more specialized vehicles have been created. A whole wave concerned technology with Big Data funds (Edmond de Rothschild AM), artificial intelligence (La Financière de l’Echiquier) or cybersecurity (Allianz Global Investors). Recently, we have noted the creation of very diverse portfolios to explore the world of the metaverse at Axa IM, on the theme of green hydrogen at CPR AM or to focus on responsible fashion at Robeco. Enough to meet all convictions.

Green units of account

Over the past two years, these products have been less popular due to generally disappointing performance. However, given the climate transition, the long-term trend remains unavoidable and most contracts have been equipped with “green” offers. These can take different forms, and in particular target renewable energies, such as BlackRock Global Funds Sustainable Energy (BlackRock), or Pictet-Clean Energy Transition (Pictet AM). The latter offers a broader spectrum since it also targets energy efficiency as well as the technologies and infrastructure necessary to achieve it. In this area, also note the existence of the unlisted UC Eiffel Infrastructures Vertes (Eiffel IG).

Besides, there is a range of “climate” offers, the strategy of which can vary greatly. Most of them target companies offering solutions to reduce greenhouse gas emissions, but they can also target companies making efforts to reduce their impact on the planet. These include Dorval European Climate Initiative (Dorval AM), BNP Paribas Climate Impact (BNP Paribas AM), and the CPR Invest Climate Action fund (CPR AM).

An article from the L’Express special report “Investing in 2024: the right strategies for an uncertain environment”, published in the weekly on February 15.

.