(Finance) – Volatile and directionless session on Wall Streetwith investors who find themselves evaluating the prospects of a more aggressive rate hike by central banks and the unknowns on global growth. The World Bank cut its global growth forecast by 1.2 points, to 2.9% for 2022, with the war in Ukraine likely to lead to “a prolonged period of weak growth and high inflation”.

On the macroeconomic front, the US trade deficit fell to $ 87.1 billion in April 2022. Specifically, the deficit with China decreased by $ 8.5 billion, the highest in seven years, and imports fell by 10.1 billion, including in this case the highest since 2015, due to lockdowns in China and limited activity by factories.

Target is down after it announced a series of actions to downsize its own inventorywith effects on margins for the current quarter. Kohl’s on the other hand, it is on the rise after it announced that it is in exclusive negotiations to be acquired by Franchise Group.

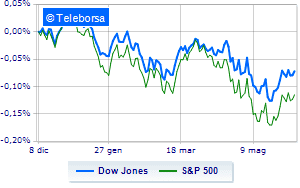

The US price list shows a shy earningwith the Dow Jones which is achieving + 0.2%; on the same line, small step forward for theS & P-500, which reaches 4,131 points. Just above parity the Nasdaq 100 (+ 0.27%); along the same lines, fractional earnings forS&P 100 (+ 0.23%).

Power (+ 2.45%), informatics (+ 0.62%) e industrial goods (+ 0.44%) in good light on the S&P 500 list. Among the worst on the S&P 500 list, the compartments secondary consumer goods (-1.10%) e utilities (-0.42%).

At the top of the ranking of American giants components of the Dow Jones, Chevron (+ 1.82%), Salesforce (+ 1.78%), Apple (+ 1.22%) e American Express (+ 0.97%).

The strongest sales, on the other hand, show up on Wal-Martwhich continues trading at -2.20%.

It slips Home Depotwith a clear disadvantage of 1.71%.

In red Walt Disneywhich shows a marked decrease of 1.14%.

He hesitates Walgreens Boots Alliancewith a modest decline of 0.90%.

Between best performers of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 7.93%), Crowdstrike Holdings (+ 5.49%), Atlassian (+ 4.35%) e Modern (+ 4.34%).

The strongest sales, on the other hand, show up on Amazonwhich continues trading at -2.25%.

The negative performance of Ross Storeswhich falls by 1.49%.

Booking Holdings drops by 1.33%.

Decline for Ebaywhich marks a -1.09%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 07/06/2022

14:30 USA: Balance of trade (expected -89.5 B $; previous -107.7 B $)

Wednesday 08/06/2022

4:00 pm USA: Wholesale stocks, monthly (previous 2.7%)

16:30 USA: Oil inventories, weekly (expected -1.8 million barrels; previously -5.07 million barrels)

Thursday 09/06/2022

14:30 USA: Unemployment Claims, Weekly (Expected 207K Units; Previously 200K Units)

Friday 10/06/2022

14:30 USA: Consumer prices, yearly (8.3% expected; 8.3% before).