(Finance) – First session of August without direction for the New York Stock Exchange, which closed the last session of last week and July up, supported by some brilliant corporate quarterly reports. Over the past month, the three major equity indices have posted their best performance since 2020. Investors find themselves evaluating new comments from Federal Reserve officials and data showing a slower growth in the manufacturing sector. “Markets could test the substantial rally that took place last week as they consider the progress made so far by the Federal Reserve to stem the course of inflation,” wrote John Stoltzfus, chief investment strategist at Oppenheimer.

Today most of the quarterly results comes after the market closes, with investors looking at the performance of Devon Energy, Diamondback, Activision Blizzard, CF Industries, Avis. Eyes on ADR from HSBCafter the British banking giant promised to bring its dividend back to pre-pandemic levels as it posted better-than-expected second-quarter earnings.

The sales of the main ones continue to increase Chinese electric vehicle manufacturers (NIO, Xpeng And Auto them), while Alibaba would be working for maintain its listing on the New York Stock Exchange along with the Hong Kong listing after being placed on a watchlist for delisting by US authorities.

On front of the M&A, Nikolaa US company that produces low-emission commercial vehicles, has entered into a definitive agreement to acquire Romeo Powerprovider of advanced electrification solutions for commercial vehicles. Global Paymentsa leading operator of payment technologies and software solutions, has reached an agreement to acquire EVO Paymentsprovider of payment technology integrations and acquiring solutions.

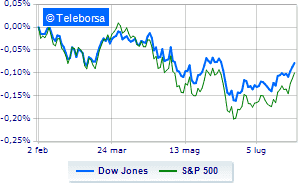

On Wall Street, the Dow Jones it is substantially stable and is positioned at 32,862 points; on the same line, theS & P-500, which continues the day at 4,124 points. Consolidate eve levels on Nasdaq 100 (+ 0.12%); as well, on parity theS&P 100 (-0.05%).

Consumer goods for the office (+ 1.37%) e secondary consumer goods (+ 0.84%) in good light on the S&P 500 list. Among the most negative ones on the S&P 500 list, we find the compartments power (-2.86%), financial (-0.95%) e materials (-0.89%).

Between protagonists of the Dow Jones, Boeing (+ 6.44%), Procter & Gamble (+ 3.15%), Home Depot (+ 1.75%) e IBM (+ 1.38%).

The strongest falls, on the other hand, occur on Chevronwhich continues the session with -2.42%.

The negative performance of DOWwhich falls by 1.78%.

Travelers Company drops by 1.66%.

Decline for Caterpillarwhich marks a -1.65%.

On the podium of the Nasdaq titles, Datadog (+ 2.30%), Meta Platforms (+ 2.16%), Docusign (+ 2.06%) e Dexcom (+ 1.91%).

The strongest sales, on the other hand, show up on Pinduoduo Inc Spon Each Repwhich continues trading at -3.41%.

Letter on Baiduwhich records a significant decrease of 2.79%.

Goes down JD.comwith a decrease of 2.47%.

Collapses Biogenwith a decrease of 2.30%.

Between macroeconomic variables most important in the North American markets:

Monday 01/08/2022

15:45 USA: Manufacturing PMI (expected 52.3 points; preceding 52.7 points)

4:00 pm USA: Manufacturing ISM (expected 52 points; previous 53 points)

Wednesday 03/08/2022

15:45 USA: Composite PMI (expected 47.5 points; preceding 52.3 points)

15:45 USA: PMI services (expected 47 points; preceding 52.7 points)

4:00 pm USA: ISM non-manufacturing (53.5 points expected; previous 55.3 points).