(Finance) – Difficult session for Piazza Affariwhich trades in sharp decline, in agreement with the other continental lists, which suffer substantial losses.

Weak session forEuro / US dollar, which trades with a drop of 0.60%. L’Gold the session continues just below par, with a drop of 0.66%. Day to forget for oil (Light Sweet Crude Oil), which trades at 98.38 dollars per barrel, with a decline of 3.62%.

Salt a lot spreadreaching +174 basis points, with a marked increase of 9 basis points, while the 10-year BTP has a yield of 2.61%.

Among the markets of the Old Continent sales on Frankfurtwhich records a decline of 1.01%, a drop of Londonwhich shows a fall of 1.66%, and negative session for Pariswhich shows a loss of 1.36%.

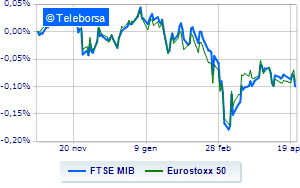

A negative sign for the Milanese list, in a session characterized by large sales, with the FTSE MIB which accuses a decrease of 1.22%: the main index of the Milan Stock Exchange thus continues a negative series, which began last Thursday, of three consecutive declines; along the same lines, the FTSE Italia All-Share loses 1.19%, continuing the session at 26,252 points.

Just below parity the FTSE Italia Mid Cap (-0.68%); as well, downhill the FTSE Italia Star (-0.97%).

At the top of the ranking of the most important titles of Milan, we find A2A (+ 1.26%), Is in the (+ 1.05%) e Hera (+ 0.80%).

The strongest sales, on the other hand, show up on Tenariswhich continues trading at -4.73%.

Under pressure ENIwhich shows a drop of 3.61%.

It slips CNH Industrialwith a distinct disadvantage of 3.06%.

Letter on Saipemwhich records a significant decrease of 2.75%.

Among the protagonists of the FTSE MidCap, ERG (+ 1.68%), Acea (+ 1.14%), Rai Way (+ 0.79%) e Mfe B (+ 0.76%).

The strongest falls, on the other hand, occur on Salcef Groupwhich continues the session with -3.19%.

Goes down OVSwith a decline of 2.90%.

Collapses Safilowith a decrease of 2.62%.

Sales hands on Saint Lawrencewhich suffers a decrease of 2.53%.