(Tiper Stock Exchange) – All the main European stock exchanges are down. Bad day also for the Milanese price list, which however shows less significant declines. Weigh theincrease in interest rates implemented this week by major central banks, including the Bank of England, Norges Bank and the Swiss National Bank, and fears of long-term high inflation.

On the macroeconomic frontthis morning it emerged that the business growth in the euro area it all but stalled in June as the manufacturing downturn worsened and activity in the services sector lagged, according to S&P Global’s HCOB PMI.

Few ideas in Piazza Affariapart from the announcement of Eni for the acquisition with Var Energi of Neptune Energy, for an enterprise value of 4.9 billion dollars, and that of De Nora on the assessment given to Thyssenkrupp Nucera, a joint venture for hydrogen technologies between the Italian and German companies Thyssenkruppwhich will land on the Frankfurt Stock Exchange on 7 July.

Weak session forEuro / US Dollar, trading down 0.55%. L’Gold, up (+1.02%), reaching 1,933.5 dollars an ounce. Strong reduction of petrolium (Light Sweet Crude Oil) (-2.87%), which reached 67.52 dollars per barrel.

Small step to the top of the spreadswhich reaches +158 basis points, showing an increase of 3 basis points, with the yield of the 10-year BTP equal to 3.90%.

Among the main European Stock Exchanges decided decline for Frankfurtwhich marks a substantially weak -1.35%. Londondown 0.65%, and under pressure Pariswith a sharp drop of 0.86%.

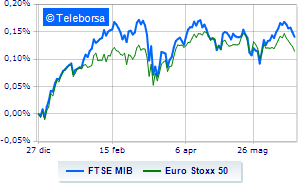

“No” day for the Italian stock exchangedown by 0.81% on FTSEMIB; along the same lines, bad day for the FTSE Italia All-Share, which continued the session at 29,243 points, down 0.80%. Negative the FTSE Italia Mid Cap (-0.78%); on the same trend, negative changes for the FTSE Italy Star (-0.81%).

At the top of the ranking of the most important titles of Milan, we find Hera (+1.18%), Ferrari (+0.75%), Italgas (+0.75%) and Inwit (+0.64%).

The worst performances, however, are recorded on Saipem, which gets -3.86%. He suffers Prysmian, which shows a loss of 2.95%. Prey of sellers STMicroelectronics, with a decrease of 2.46%. They focus their sales on CNH Industrialwhich suffers a drop of 2.13%.

Among the protagonists of the FTSE MidCap, Luve (+2.05%), Bff Bank (+1.40%), CIR (+1.35%) and IREN (+1.29%).

The strongest sales, on the other hand, show up De Nora Industries, which continues trading at -5.37%. Sales on Technogym, which records a drop of 3.33%. Bad sitting for Saphilus, which shows a loss of 2.94%. Under pressure Maire Tecnimontwhich shows a drop of 2.65%.