The Chinese economy, second in the world, is going through a bad patch. This Wednesday, August 9, the country even went into deflation, the opposite of inflation, weighed down by sluggish domestic consumption. The Express provides an overview of the main obstacles to a stable economic recovery in China.

Sluggish consumption

China has multiplied in recent weeks the announcements supposed to restart consumption. But without tackling the root of the problem, according to analysts from the firm Trivium, which specializes in the Chinese economy.

“Policymakers have no idea how to increase household incomes,” they lament in a note. Because the recovery is running out of steam, the labor market is under pressure (one in five young people is unemployed) and households are tightening their belts. As long as this problem has not been resolved and “the economic outlook remains uncertain”, consumption “will not pick up again”, warns Trivium.

Deflation at 0.3%

For the first time in more than two years, China entered deflation on Wednesday, in contrast to the main economies which are fighting against inflation. Deflation is the opposite of inflation, i.e. falling prices of goods and services. The consumer price index in China, the main gauge of inflation, fell in July by 0.3% over one year, according to the National Bureau of Statistics (BNS).

If on paper this phenomenon may seem a good thing for purchasing power, deflation is a threat to the economy. Because instead of spending, consumers postpone their purchases in the hope of more price cuts, which weighs on the recovery of the economy. For lack of demand, companies are thus forced to reduce their supply, and therefore their production, and agree to new discounts to sell off their stocks, while they freeze hiring or lay off workers.

“Deflation reflects the reality of the recovery in China running out of steam and the need for a strong stimulus package to stimulate insufficient demand,” analyst Ken Cheung, from Japanese bank Mizuho, told the Agency. France Press. China experienced a short period of deflation at the end of 2020-early 2021, due to the collapse in the price of pork, the most consumed meat in the country. Many analysts fear a longer period this time, when China’s main growth engines are seized up and youth unemployment is at a record high of over 20%.

Inflation in China

© / AFP

Real estate in crisis

Stone is a pillar of the economy, in a country where construction has long been a sure way for the Chinese to grow their savings. But the financial setbacks of a large part of the promoters, many of whom are now fighting for their survival, are fueling a crisis of confidence with potential buyers. The central bank has extended its support for developers until the end of 2024, in particular via loan repayment extensions, to allow groups to complete ongoing projects and thus reassure buyers.

But the results may not be up to scratch, warns analyst Ting Lu of Nomura Bank, due to households’ “lack of confidence in the future” and “population decline” in China. This phenomenon should contribute to a lasting decline in real estate prices and reduce interest in real estate investments.

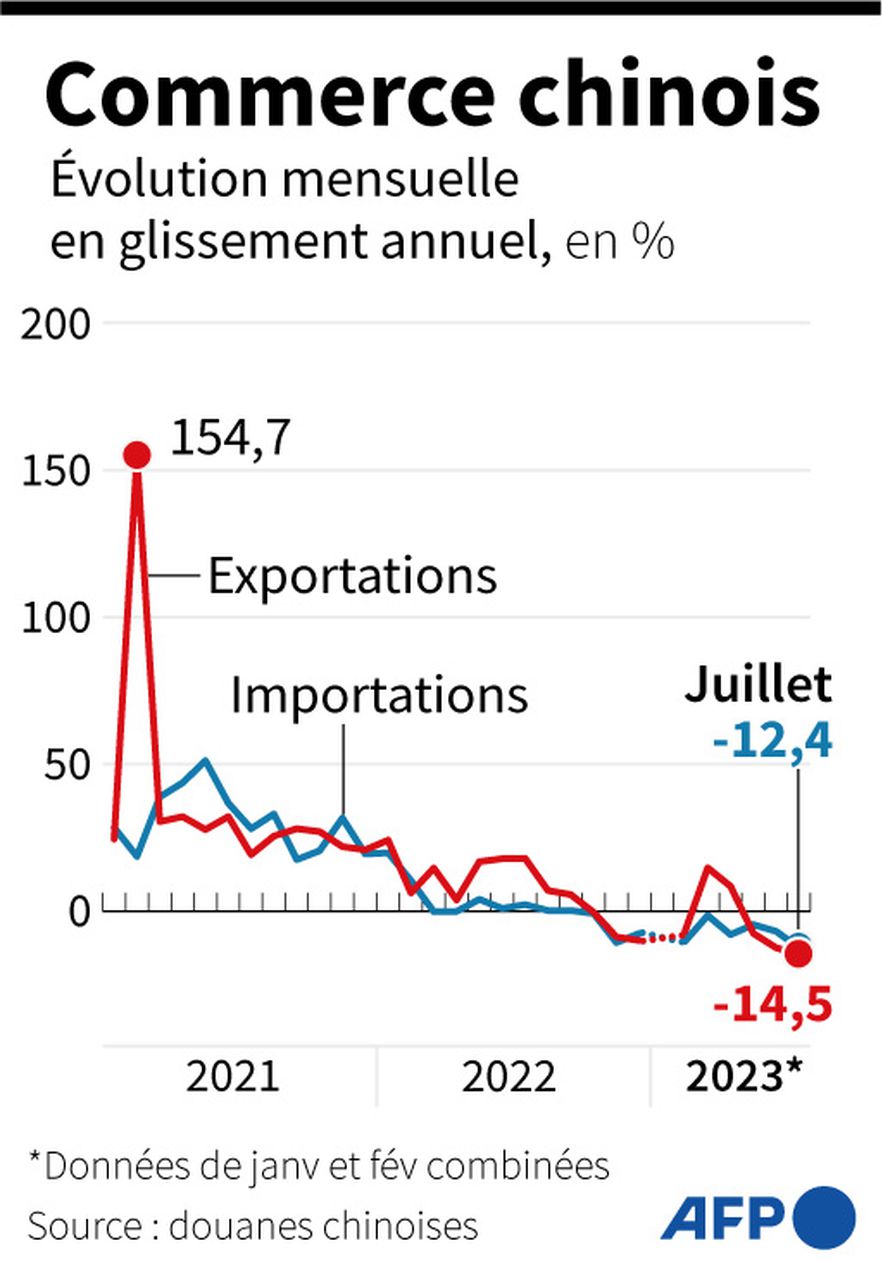

Geopolitical tensions and decline in exports

In a context of tensions with Beijing, some political leaders in the West advocate “decoupling” with China, that is to say, to cut all economic ties, or at least to limit their dependence. As a result, “foreigners are reducing their investments in China”, observe analysts from SinoInsider, a firm specializing in China and based in the United States. They fell in the second quarter to their lowest level since 1998, according to the American investment bank Goldman Sachs.

China’s exports have experienced their biggest decline in more than three years, penalized by sluggish demand abroad and the economic slowdown in the country, which are weakening thousands of companies. Last month, sales of Chinese products destined for overseas fell 14.5% year on year, according to dollar figures released Tuesday by China Customs. Apart from a brief rebound in March and April, the Asian giant’s overseas sales have generally been in constant decline since October 2022.

Chinese trade

© / AFP

A shrinking GDP due to heat waves?

The recent heat waves could cut global GDP by nearly 0.6 points in 2023, according to an “estimate” by credit insurer Allianz Trade. “In recent months, the United States, Europe, China, and other countries in Asia have faced record temperature rises. […] Climate change will increase the frequency and intensity of extreme heat, creating a + new normal + of heat waves, droughts and fires. Such events not only impact people and wildlife, but also economies,” Allianz Trade said in a study released this week.

According to estimates, China could see its GDP reduced by 1.3 points, according to these calculations, Spain by 1 point, Greece by 0.9 point, Italy by 0.5 point, the United States by 0.3 point and France by 0.1 point.