(Finance) – In sharp decline Deere, which shows a -2.95% despite the tractor manufacturer having raised its earnings forecast for 2022. In addition, the first quarter closed with earnings per share of $ 2.92 on revenues of 8.53 billion. . The data sounded above analysts’ expectations

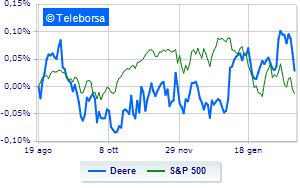

The technical scenario seen at one week of the stock compared to the index S & P-500highlights a slowdown in the trend of Deere compared toUS basketball indexand this makes the stock a potential target for sale by investors.

The medium-term scenario is always positively connoted, while the short-term structure shows some yielding, as read by the relative indicators, due to the opposition of the estimated resistance at USD 386.2. The control of the short-term situation offered by the supports at 359.2 is functional. There is a concrete possibility of a continuation of the corrective phase towards 349.2.