The declaration must soon be approved and submitted, at least if you want the money just for Easter. But what do you not have to deduct really, which may have been possible before? It works out News24.

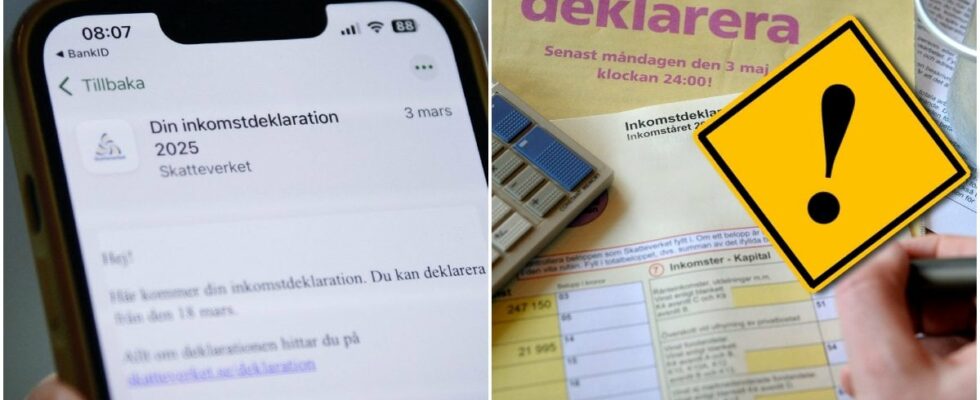

Millions of Swedes have now received their income declarations for the income year 2024. At least those who have announced a digital mailbox, like Kivra or Billo. Between March 17 and April 15, the Swedish Tax Agency conducts the work on sending out the paper declaration to others who have not chosen to receive their digital declaration.

Read more: Declaration 2025: Are you examined by the Swedish Tax Agency this year?

Don’t miss: Latest news – take part in what is happening right now

Then you get the tax refund paid out from the declaration in 2025

Now you who have received your declaration until April 2 have on you to approve, without changes or additions, in order to receive any tax refund already at Easter.

However, you who intend to make changes or additions to your declaration, and do so by May 2, can look forward to any refund in early June instead.

In that case, it is of great importance that you are in control of what deductions you can make but also what deductions you cannot make. Some may even have been possible to do before, but for some reason changes have occurred that now make it impossible for you to seek deductions.

Read more: List: Here are all deductions you can make in the Declaration 2025

March 17 to April 15: The Swedish Tax Agency sends out the paper declaration.

March 18: You who have to declare digitally with e-identification can do so.

April 2: The last day to approve the declaration without changing or adding anything – if you want to receive any tax refund in April.

May 2: Last day to declare for those who have been deferred.

Source: The Swedish Tax Agency

Don’t miss: Everything About Remaining Tax 2025: Interest and last day to pay

The deduction many make errors in the declaration

To find out what actually applies has News24 Talked to the tax lawyer Ola Aronssonwho works everyday at the family lawyer. He says that many, on a unique occasion, should think about it as it easily gets wrong.

-If you have received a house in connection with a housing division, or received a property as a gift, you use the value that you, for example, redeem your sibling or ex-wife with. But then you must not use the sum you buy someone for as an acquisition price, he says and then develops:

– There I think many people make mistakes, you simply think you made a purchase but a money that bought someone in the housing division or inheritance may not be used as a acquisition value.

Don’t miss: New deductions in the declaration 2025 – you should be aware

You may not deduct this in the declaration 2025

When it comes to something you are not allowed to deduct, Aronsson is quick to point out that there is a deduction that, just a few years ago, was common in many Swedes’ declarations.

– One thing that was common to deduct during the pandemic was when many people made deductions for offices in the home, but it basically no longer works. Home office is said no to purely categorically, he states and concludes:

– There are some opportunities but they are disappearing few.

Read more: So expensive it will be if you do not declare in time 2025

Read more: News Today – Current news from Sweden and the world