REAL ESTATE OWNERS DECLARATION. A bug on the tax site has prevented owners from making their new declaration. The deadline for doing so has been pushed back.

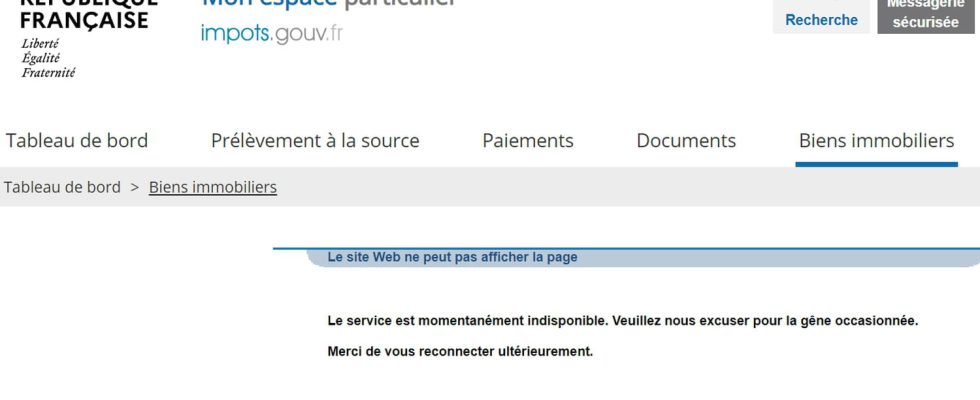

Obviously, there were many latecomers! The website of taxes experienced a peak in connections, this Monday, July 31, 2023. The reason: it was the last day for owners to make their declaration of occupation of their property (s). An influx that has led to problems of access to personal spaces, preventing many owners from going through with the process. Thus, faced with these difficulties, the Ministry of the Economy has announced that it will grant an additional period. The form can be completed throughout the day of the Tuesday, August 1until midnight.

In 2023, each owner (natural or legal person) is now subject to a new reporting obligation. Each property for residential use must be declared to taxes. This new declaration comes after the abolition of the housing tax for main residences. The objective: to determine the owners still liable for housing tax (secondary residence, rental accommodation) or tax on vacant homes. In total, 34 million owners are affected by this new declaration to the tax authorities, for 73 million premises for residential use in France.

The deadline for declaring your residential property is fixed at August 1, 2023 for all owners. This deadline remains the same whether you are an individual or a company.

In the event of failure to comply with this new tax declaration obligation, or of an incomplete declaration, a fine of a fixed amount of 150 euros per room may be applied.

This new declaration on real estate concerns all owners, individuals or companies, real estate for residential use (main residence, secondary residence, rental property, vacant accommodation). Are you joint owners? Usufructuary? Do you have a civil real estate company (SCI)? You are also subject to this obligation in 2023.

The declaration of your real estate for residential use must be made online, via the “Manage my real estate” service, in your personal or professional space on the site. impots.gouv.fr. Log in to your personal space using your tax number and your password. Go to the “Real estate” tab to declare each of your properties, one by one. Main or secondary residence, rented premises, vacant premises, cellar or parking space For example. You must also indicate in what capacity you occupy your accommodation. If you do not occupy it yourself, it is mandatory to indicate the identity of the occupants and the period of occupation (situation as of January 1, 2023).

As for the tax declaration, be aware that the occupation data is known to the tax authorities, and will therefore be pre-filled. Thereafter, only a change of situation will require a new declaration.

No. The declaration can only be made on the tax website. However, the taxes indicate that it is possible to call your nearest tax center in order to be helped in the process in the event of difficulties.