(Finance) – Snap’s thudwhich drags down companies that rely on digital advertising for their revenues, rekindles the sell-off on Wall Street, with the indices falling sharply. Investors are concerned about the downward revisions of the outlook for the current year by several companies, fueling concerns about an economic slowdown. Other negative news came from the publication of macroeconomic datawith PMI indices showing commercial activity slowed in May, while new home sales plunged to a two-year low in April, likely due to rising mortgage rates and rising prices.

Snap tumbled after revising its revenue and EBITDA guidance downward, despite estimates being provided last month. The company stated that the conditions worsened “further and faster” expected. Consistent discount also for Abercrombie & Fitchafter the company cut its sales forecast and withdrew its full-year forecast for gross margin and costs, citing the “volatility in freight transport and other costs“. It also goes down Best Buywith the company slashing its sales and profit forecasts for the current year.

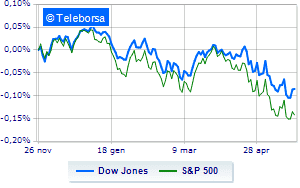

Minus sign for the US list, in a session characterized by large sales, with the Dow Jones which accuses a drop of 1.03%; along the same line, theS & P-500, which continues the session at 3,895 points. Heavy on Nasdaq 100 (-3.18%); with similar direction, depressed theS&P 100 (-2.13%).

The sector is highlighted on the North American S&P 500 list utilities. Among the most negative on the list of the S&P 500 basket, we find the sectors telecommunications (-5.12%), secondary consumer goods (-3.29%) e informatics (-2.58%).

Between protagonists of the Dow Jones, McDonald’s (+ 2.07%), IBM (+ 0.79%), Wal-Mart (+ 0.77%) e Coke (+ 0.67%).

The worst performances, on the other hand, are recorded on Boeingwhich gets -5.14%.

Negative sitting for Walt Disneywhich falls by 4.93%.

Sensitive losses for Appledown 3.32%.

Breathless American Expresswhich fell by 3.24%.

To the top between tech giants of Wall Streetthey position themselves Zoom Video Communications (+ 4.74%), O’Reilly Automotive (+ 3.95%), Electronic Arts (+ 2.22%) e American Electric Power (+ 0.87%).

The strongest falls, on the other hand, occur on Dexcomwhich continues the session with -11.43%.

Thud of Meta Platformswhich shows a drop of 9.58%.

Letter on Datadogwhich records a significant decline of 9.11%.

Goes down Mercadolibrewith a decrease of 8.92%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 24/05/2022

15:45 USA: Composite PMI (preceding 56 points)

15:45 USA: Manufacturing PMI (expected 57.5 points; preceding 59.2 points)

15:45 USA: PMI services (expected 55.2 points; preceding 55.6 points)

4:00 pm USA: New house sales, monthly (previous -10.5%)

Wednesday 25/05/2022

14:30 USA: Durable goods orders, monthly (expected 0.6%; previous 0.8%).