(Finance) – After a momentary turbulence immediately after the release of the key data on US inflation, the European stock exchanges they settled back to the previous levels for then strengthen slightly at the end of the session, thanks to the contemporary improvement of Wall Street. “US inflation in December was in line with expectations in the general and core part, supporting the possibility that in February the Fed could further decelerate the pace of rate hikes from 50 to 25 bps”, commented Antonio Cesarano, Chief Global Strategist Of Intermonte.

The best of the FTSE MIB is Ivecoon which purchases continue after yesterday announcing an agreement for the supply of 150 electric buses to Busitalia (FS Italian group). “The amount represents 2% of the division’s annual turnover, but represents further confirmation of the validity of electrical products,” he comments. Equitywhile Bestinver talks about “positive and not obvious” news. Intesa Sanpaolo instead, he believes that the group “has room to expand further into the electric bus segment”.

He suffers Campariafter a downgrade to Underperform from Neutral by Exane Bnp Paribas (target price at 8.30 euro) and the cut of the target price to 11.55 from 12.15 euro by Deutsche Bank.

On equality generalsalthough UBS has judgment cut from Neutral to Sell, however raising the target price from 14.70 to 15.50 euros. Analysts noted that shares have appreciated 24% in the past three months, outperforming the insurance sector by almost 5 percentage points.

Slight growth ofEuro / US Dollar, which rises to 1.081. L’Gold trading continues at 1,891.9 dollars an ounce, an increase of 0.82%. The Petrolium (Light Sweet Crude Oil), up (+1.66%), reaching 78.69 dollars per barrel.

Consolidate the levels of the eve lo spreadsreaching +185 basis points, with the yield of 10-year BTP which stands at 3.98%.

In the European stock market scenario good insights on Frankfurtwhich shows a large lead of 0.74%, well set Londonshowing an increase of 1.07%, and toned Paris which highlights a nice advantage of 0.74%.

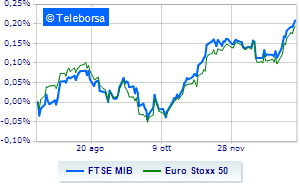

Earnings day for Milan Stock Exchangewith the FTSEMIB, which shows a capital gain of 0.73%; along the same lines, slight increase for the FTSE Italia All-Sharewhich rises to 27,656 points.

On equality the FTSE Italia Mid Cap (+0.11%); slightly below parity the FTSE Italy Star (-0.23%).

In Piazza Affari it appears that the exchange value in today’s session it was equal to 2.14 billion euros, with an increase of no less than 453.4 million euros, equal to 26.96% compared to the previous 1.68 billion; while the volumes traded went from 0.57 billion shares in the previous session to today’s 0.65 billion shares.

Among the best Blue Chips of Piazza Affari, exploit of Ivecowhich shows an increase of 4.36%.

In light Leonardowith a large progress of 1.99%.

Positive trend for Pirelliwhich rises by a fair +1.75%.

Well bought Telecom Italywhich marks a sharp rise of 1.54%.

The worst performances, however, were recorded on amplifierwhich closed down -1.98%.

Under pressure Campariwhich shows a drop of 1.89%.

Slide DiaSorinwith a clear disadvantage of 1.70%.

Moderate contraction for Interpumpwhich suffers a decline of 1.00%.

Between best stocks in the FTSE MidCap, Saras (+6.81%), Mortgages online (+4.39%), Ascopiave (+2.50%) and Antares Vision (+2.24%).

The strongest sales, however, fell on CIRwhich finished trading at -3.76%.

In red Drywhich shows a marked decrease of 3.23%.

The negative performance of Mfe Bwhich drops by 3.16%.

Juventus drops by 3.04%.