The year 2022 has changed the situation on the bond market, the one where debt securities issued by States and companies are traded. The rise in interest rates has in fact given new color to the remuneration offered by these investments, which had been moribund in recent years. As a result, bonds issued by so-called companies investment-grade, that is, the highest quality segment, made up of companies with a very solid financial profile, currently offer investors an average return of around 4.5%. Companies with a quality one notch below, because they are smaller and more indebted, pay around 6 to 8%. This is then referred to as “high yield”, or high-yield in jargon. These are levels that had not been observed for fifteen years.

To take advantage of this opportunity, new products have flourished in recent months. Many management companies have launched fixed-maturity bond funds, also called “dated” funds because they have a limited lifespan. Moreover, their name always includes the year of their term (2026, 2027 or 2028 most of the time for this last generation). The concept is quite simple at first glance: when they are created, a portfolio of securities is composed. Depending on the objective of the fund, these may be securities investment-grade or high yield, or a combination of both. Then, it is a question of collecting the interest paid by the companies over water and waiting for the reimbursement of the bonds at maturity at their initial value. “These are carry strategies, that is to say that in theory the portfolio will be fixed for the life of the fund, and that its composition will change very little”, indicates Raphaël Thuin, director of strategies of capital markets at Tikehau Capital. Small subtlety: the redemption of securities must match as closely as possible with the end of life date of the fund so that the manager can reimburse the capital to unitholders on the scheduled date.

The main risk of seeing the promised return elude you is that an issuer does not settle its debts on time. To limit this threat, these funds invest in a wide variety of securities, with portfolios possibly containing more than 100 issuers. In addition, within the selected universe, the manager filters the different companies to retain those that seem to him to be of better quality. “This selection is very important for targeting issuers whose ability to pay their interest and repay their loan on the due date seems to us to be the greatest”, specifies Raphaël Thuin.

“The customer knows where he is stepping”

These supports have an additional advantage compared to traditional bond funds: their conditions are planned in advance, so that they offer great clarity to savers. “They make it possible to display a contractual investment period, a target return and a clear level of risk. The client therefore knows where he is stepping”, summarizes Yves Conan, general manager of Linxea. In addition, the potential danger decreases as the deadline approaches, since the uncertainties about the health of the company are reduced. However, these products are not totally immune to a decrease in value during their lifetime, especially if interest rates continue to rise. This phenomenon will naturally alter the valuation of bonds issued previously with a lower rate. “In the event of a rise in interest rates, the net asset value of the fund will fall, but, as we get closer to maturity, it will rise until it reaches the expected performance, excluding credit events on positions held”, underlines Julien Maio, director of interest rate management at Crédit Mutuel Asset Management. This is why it is recommended to keep the fund until its term.

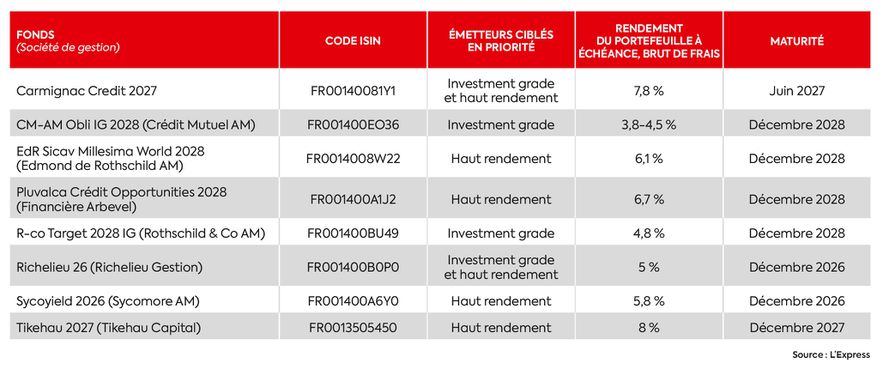

CT3747_table-bond-funds

© / The Express

Knowing that the offer is more and more vast, you should not let yourself be blinded by the only announced remuneration. This must be studied in the light of the level of risk taken by the fund. So, you have to look at the composition of the portfolio. “A product with a high percentage of titles investment-grade will be very defensive, while that dominated by high yields will be more tonic”, underlines Yves Conan. If this last segment was acclaimed last year, professionals now believe that the risk-reward ratio of more defensive products is very favorable.”In the current market configuration, we recommend as a priority to invest in the segment investment-grade, says Julien Maio. Indeed, high-yield debt involves more uncertainties for a surplus of remuneration that we currently consider too limited. Currently, the default rate is very low, at less than 1% in 2022, but it could rise to between 4 and 5% this year.” A level that remains reasonable, however. “On our R-co Thematic 2026 fund High Yield, we embark on an 8% return gross of fees, which allows us to absorb some defaults without causing our clients to lose money,” said Emmanuel Petit, head of bond management at Rothschild & Co. Asset Management.

The number of lines in the portfolio can be another interesting risk indicator, because the more the fund is concentrated on a reduced number of players, the more a default will have an impact on the return. For knowledgeable investors, one last point may be relevant to look at. This is the percentage of securities whose maturity comes after the end of the fund’s life. This creates an additional danger, because if these securities are still in the portfolio at this maturity, the manager will have to sell them at more or less good prices depending on the context of the moment. “We believe that some of these bonds will be repaid before the term by the issuer, justifies Emmanuel Petit. This also allows us to access a wider investment universe.”

A bonus on fund performance

The right product identified, how to integrate it into a life insurance contract? The most conservative strategies can be used as an alternative to investing in euro funds. “They make it possible to seek diversification and, why not, to recover a bonus on the return of the fund in euros when the insurer provides for it”, notes Yves Conan. On the contrary, the more risky supports can be considered instead of an investment in shares.

Finally, it is good to know that most of these products are marketed for a period of only a few months when they are launched. And that, to guarantee the stability of the portfolio, some of them provide for an exit penalty in the event of withdrawal of capital before the end of the fund’s life.