(Finance) – Undertone Cvs Healthwhich changed hands with a decrease of 1.30%.

The Rhode Island health care giant has reached an agreement to takeover of Signify Health, for a valuation of the Dallas-based company of approximately $ 8 billion. CVS has put $ 30.50 in cash on the table for every share of the company specializing in the delivery of home healthcare services.

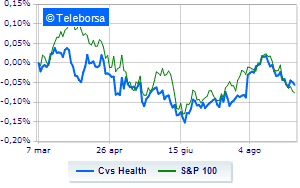

Comparing the performance of the stock with theS&P 100on a weekly basis, we note that Cvs Health maintains positive relative strength in comparison with the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance -2.17%, compared to -3.35% of theS&P 100).

The medium-term technical status of Cvs Health reiterates the negative trendline. However, analyzing the short-term chart, a less intense trend of the bearish line is highlighted, which could favor a positive development of the curve towards the resistance area identified at USD 99.55. Any bullish cues support the top target at 101.8, while the first support is estimated at 97.27.