Real roller coaster. This is what the price of cryptoassets has looked like for two years. After reaching peaks, the prices of Bitcoin and Ether, the two main digital currencies, fell by 71% and 69% respectively between November 2021 and the end of December 2022. In early January 2023, they rebounded sharply and showed, in mid-May, an increase of approximately 5%. For some more exotic cryptocurrencies, called altcoins and memecoins (in reference to memes, those humorous images or videos that make the buzz on the Internet), the variations can be even stronger.

How can such fluctuations be explained? “According to some investors, cryptocurrencies will be an increasingly popular alternative to the current monetary system and applications developed in the context of decentralized finance (DeFi) will impose themselves in our daily lives, explains Vincent Boy, market analyst at the broker IG France. But it remains a gamble. Also, as soon as an event disrupts the cryptosphere, such as the bankruptcy of the digital currency exchange platform FTX, in November 2022, the market slumps.

The very organization of the system favors this hypervolatility. There is no cryptocurrency market place capable of centralizing all buy and sell orders at the international level. In reality, it is multiple exchange platforms that provide the conversion into digital currencies and act as a trading place. Among the best known: Binance, Coinbase or Coinhouse. Each has a buy or sell order book, which splits the overall trading volumes and promotes price variations. “Quoting twenty-four hours a day, 365 days a year is a godsend for short-term speculators, analyzes Guillaume Eyssette, associate director of the wealth management firm Gefinéo. Institutional investors are present on this market but, in proportion, the weight of private individuals is greater there than on the Stock Exchange, with a non-negligible share of young people who are ready to take big risks in the hope of getting rich very quickly. take into account the many rumors and announcement effects which, relayed on social networks, regularly influence the market.”

A crypto planet difficult to decipher

Even if the “crypto planet” is not always easy to decipher, it may be wise to invest in these emerging assets in order to diversify your heritage. Provided you put in place a strategy to both minimize the risks and maximize your chances of winning over the long term.

The first step is to apply the Dollar Cost Average (DCA) method. Rather than concentrating the purchase of a cryptocurrency on an order, at the risk of acquiring it at its highest, this technique consists of regularly investing small amounts over time, which smooths the average purchase price. The impact is also psychological. “By investing in a programmed way, you no longer focus on the price of your asset, observes Vincent Boy. If the price of your digital currencies suddenly unscrews, you will be better prepared. It is less likely that you will sell at the bottom by yielding to panic.”

It is also important to define your risk appetite. If you are naturally rather cautious, favor the two main digital currencies, Bitcoin and Ether, which are theoretically less volatile. Over time, you will gain some experience with blockchain technology. Combining computing and cryptography, and associated with a specific cryptocurrency, it makes it possible to carry out financial operations in a decentralized way, without resorting to a banking intermediary. You can then bring a dose of diversification by buying other crypto-assets such as Polkadot, Cardano, Solana, Avalanche… even much less known assets, much more risky, but offering a more substantial hope of gain.

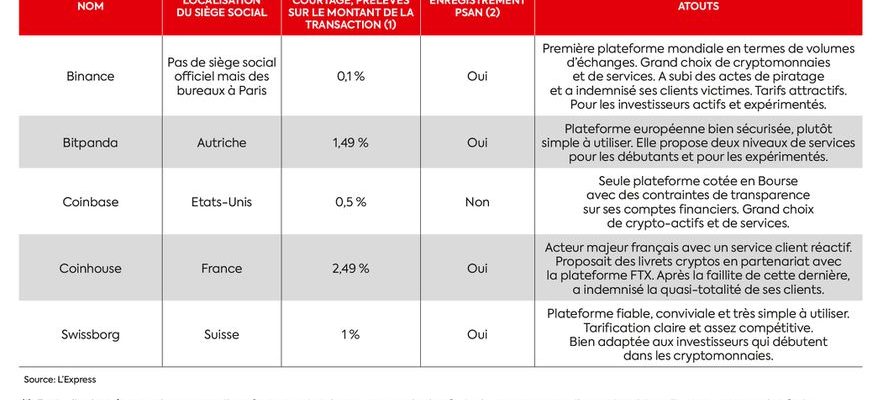

Five Cryptocurrency Exchanges Recognized for Their Reliability

© / The Express

Finally, there is a category of cryptocurrencies with “anti-volatility” properties. These are the stablecoins like USDT, USDC, DAI and Euroc. Backed by a traditional currency, such as the dollar or the euro, they are worth 1 dollar or 1 euro at any time. You can either use them as a reserve, while waiting to exchange them for other cryptoassets, or lend them by depositing them in community wallets or “cash pools”. In return, you will receive compensation. Depending on the financial app and blockchain you will be using, on average you will get returns including between 5 and 10%. But who says higher yield also says use of a less known blockchain and an application that is a priori less secure…

How to choose your platform

In this computerized environment, the exchange platform remains an obligatory point of passage to transform your euros into digital currencies. All you have to do is open an account and acquire cryptos by paying transaction fees. However, it must be chosen with discernment and not simply looking at its management costs. Especially since unlike a bank where you benefit from a guarantee of your deposits up to 100,000 euros, you will lose all of your assets in the event of the platform’s bankruptcy. It must therefore be technically flawless in order to carry out your orders quickly and have a solid financial base to deal with uncertainties. In addition, it must be well armed against hacking attempts. A word of advice: stay away from players based in tax havens such as the Bahamas or the Seychelles, and favor digital asset service providers registered with the Autorité des marchés financiers.

Those who fear the imponderable will turn to cyber risk insurance. “There are some against the bankruptcy of your exchange platform, against the hacking of your account, your digital wallet or the financial application that you use on the blockchain, reports Guillaume Eyssette. blockchain-based cooperative insurance such as Nexus Mutual or InsurAce. The cost varies according to the level of guarantee, but, on average, it is around 2.5% of the insured amount.” Protection that makes sense if you favor risky investments with high returns.